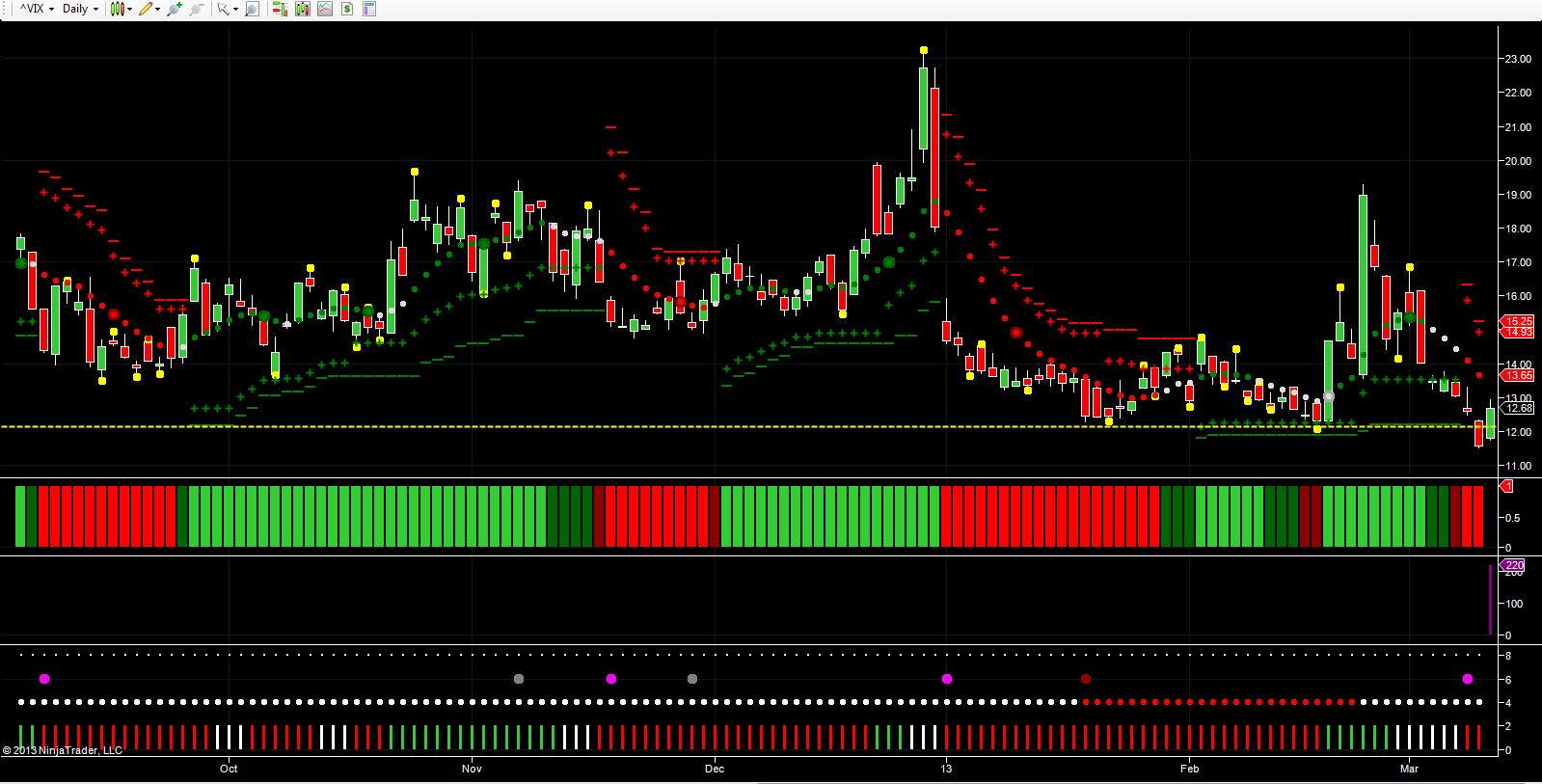

The alarm bells are starting to ring, as the VIX pushes ever lower on the daily chart, moving inexorably towards single figures where danger awaits. In yesterday’s trading session the index was trading marginally higher following Monday’s move lower to test the key support region in the 12.10 area. At time of writing the VIX was trading at 12.51 on the daily chart.

The VIX of course is the ultimate fear indicator, and with equity markets continuing to rise relentlessly, the VIX is falling with equal speed. The longer this continues, the more likely is the prospect of a major reversal, with risk appetite draining fast and money flowing back into safe haven assets.

From a technical perspective, despite yesterday’s modest move higher, the daily trend remains firmly bearish. Should the three day trend also transition from congestion to bearish, this will reinforce further bullish sentiment for equity markets. However, with the index at such low levels, it’s not a question of if, but when, and this is the problem. The VIX could indeed remain at these levels for some time, and has done so in the past. The fact that these levels are being tested does not mean that the market will reverse overnight.

What it does mean however, is that all that is required is a minor market shock or other catalyst, to send equities over the edge and markets selling-off sharply. For those with healthy profits on the table, it may be worth considering taking some off the table soon.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI