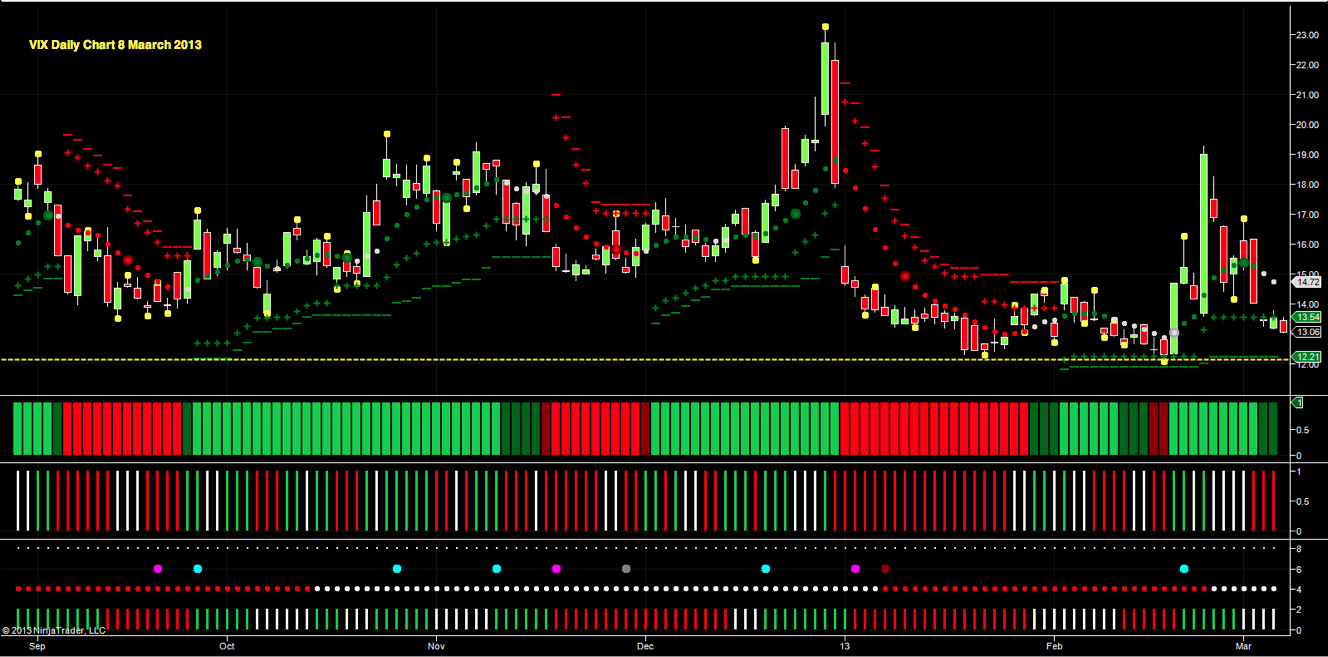

Following the sharp move higher for the VIX on 25th February which saw the index touch an intra day high of 19.28, volatility has now drained away as equity markets reach fresh highs. And with equity markets rising once again yesterday, it was no surprise to see the VIX close lower ending the session at 13.06 and moving deeper into the congestion zone created between the end of January and mid February.

Downwards pressure was also added to the index on March 1, with an isolated pivot high posted at 16.84 and coupled with a heat map in transition the outlook for the VIX is now bearish. Furthermore, this negative sentiment is also reinforced by the selling volumes evident on the daily chart. In other words, all very good news for equities!

From a technical perspective, the key level is now clearly defined in the 12.21 price region where we have the floor of potential support and should this be broken then we could see the VIX move to test single figures at which point a potential major reversal in equities becomes increasingly likely.

The trends on both time frames on the daily chart remain in congestion but should we see a transition back to bearish then this will complete our technical picture.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI