Apple edges up premarket as investors weigh estimated tariff costs, iPhone sales

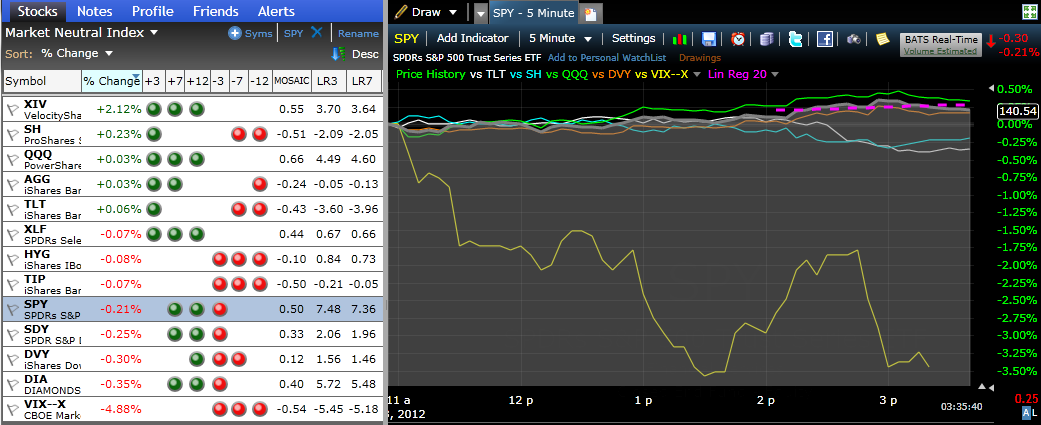

OK trader buddies…I bet this is something you didn’t think would happen so soon after the euro, Italian, Spanish, etc crises. VIX slid below 14 briefly today and what’s coming next could be a big move. Volume today is REALLY thin, about 35% normal and old time market watchers like myself are having a hard time making sense of the action. It looked like bonds were going to rule the day but that’s not the way it’s playing out.

As can be seen from chart above the VIX has been acting a bit oddly while equities and bonds have just cruised along (SPY is the shaded underlying chart). The last time we got close to this level was back in April 2011, after which the VIX commenced a spike to 43+ in the course of the next 5 months. Things are different now of course but buying a little insurance might not be an unwise move.

Bulls Pushing for a New High

The trading action is painfully slow but the market continues to hold up well after some morning profit taking. We finally had a small red close. Volatility continued to get sucked out as we transition into a grinding market. Breadth was weak, but no damage was done by the bears. Apple (AAPL) continued to run on Iphone 5 and ITV optimism. Looks like the market wants to make a push to challenge the 2012 high.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI