Apple edges up premarket as investors weigh estimated tariff costs, iPhone sales

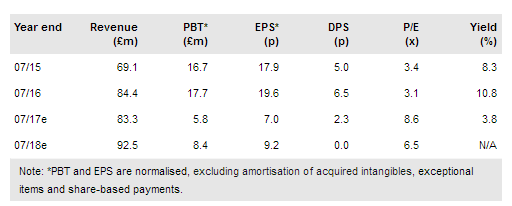

We have updated our forecasts to reflect recent announcements from Utilitywise Plc (LON:UTW), including those related to consumption volumes in ‘nominated contracts’, implementation of IFRS 15 and the trading update. While our changes have resulted in lower projections for revenues, profits and dividends, changes to revenue recognition will result in lower levels of accrued revenue and a stronger link between profits and cash flow. Following recent falls, the rating of the shares appears undemanding for a company that we expect to generate profits and cash in FY18.

Accounting changes align profits and cash flow

UTW’s recent announcements have had important effects on forecast profitability for FY17 and beyond. We now incorporate the most significant announcements – volumes related to nominated contracts (June) and the adoption of IFRS 15 and the trading update (July) – into our forecasts. Our revised forecasts for revenue and profits are lower, but we believe that following the changes to revenue recognition, the reduced levels of accrued revenue will allow UTW to establish a stronger link between profits and cash flow.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI