UnitedHealth shares surge as Buffett’s Berkshire shows new stake

Utilitywise Plc. (LON:UTW)

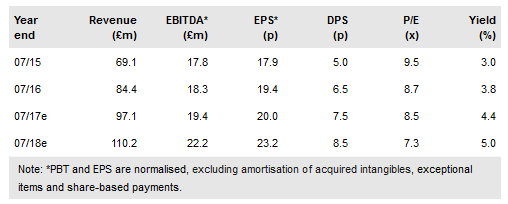

FY16 results were in line with the post-trading statement expectations and showed continuing growth, despite staff retention difficulties and investment in energy services. In FY17 we expect improved staff retention and additional energy service contracts, such as that recently signed with Asda. With improving cash flow and a strengthened management team, there is the prospect of further growth in the current year. Utilitywise’s current rating does not appear to reflect this potential for growth.

FY16 profitability in line with August trading update

FY16 figures (revenue of £84.4m and adj. EBITDA of £18.3m) were in line with the August trading update, which guided to revenues of “at least” £82m and EBITDA “greater than” £18m. Although the results were below the expectations of the pre-trading statement, the Enterprise division showed a strong H2, albeit held back by headcount retention issues. The Corporate division’s result was depressed by heavy investment in energy services, although we expect this to help revenue generation in FY17. The results nevertheless demonstrated continued year-on-year growth (revenue +22%, adj. EBITDA + 3%) and other key performance indicators showed continued momentum (Enterprise Division order book +35%). Thanks to contract renegotiations with suppliers and a reduction of extensions business, UTW also improved cash flow, reducing net debt to £0.2m (Edison FY16e net debt of £3.8m). As a mark of confidence, the DPS was increased by 30% to 6.5p/share.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.