Trump slaps 30% tariffs on EU, Mexico

Will the Fed raise rates? It looks like the utilities index is concerned about rising rates. Utilities have had a rough go of it since the first of February.

Looking back over the past 20 weeks, the Dow Jones Utilities index is down over 13% -- its worst 20-week performance since 2009. That decline has taken utilities down to a support line that dates back to the 2009 lows.

As you know, utilities are usually concerned about the direction of interest rates. I suspect that the sharp rise in rates over the past few months has had much to do with the weakness in bond prices.

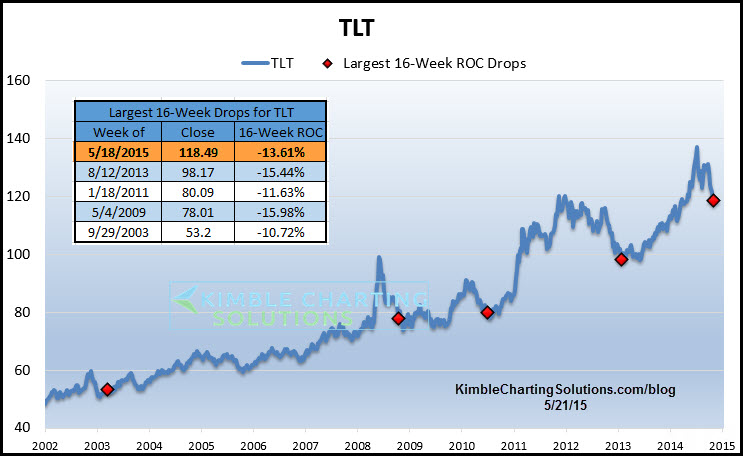

Interest-rate sensitive utilities aren’t the only asset impacted by rising rate concerns. The above chart looks at (ARCA:TLT), which shows that it just had its third worst 16-week decline in it’s history.

I shared this chart with members a few weeks ago. Back in January, the Power of the Pattern noted that the odds were high that interest rates were about to move much higher, giving 10 Reasons why they'll head higher.