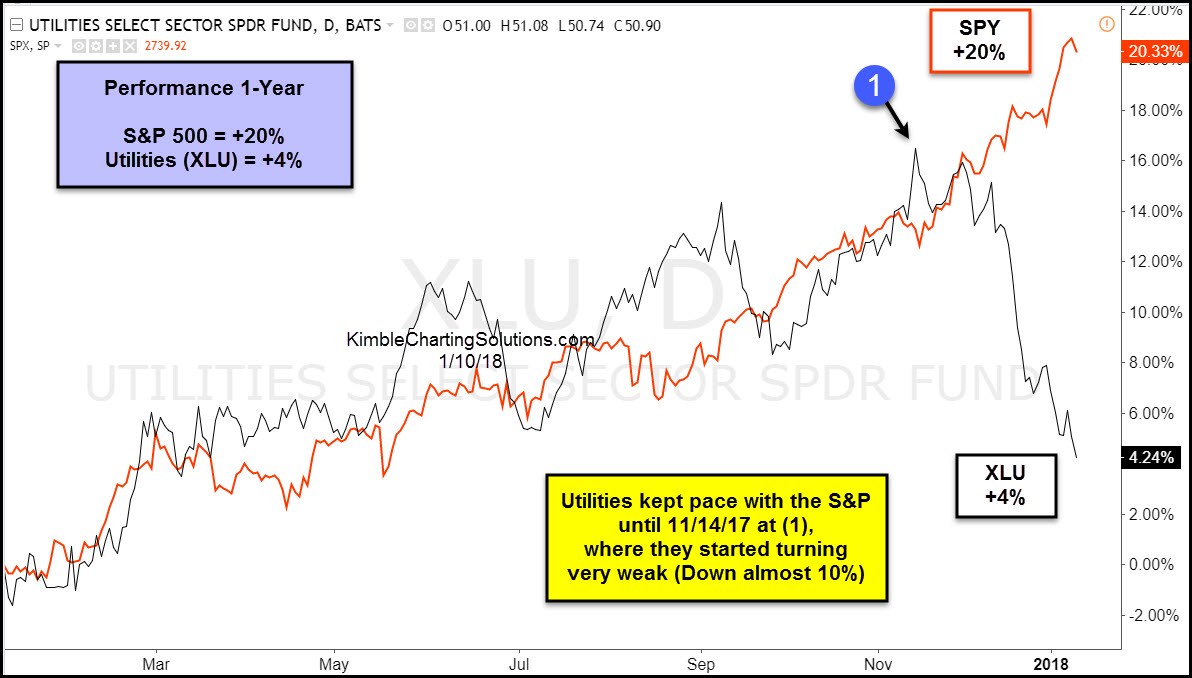

Utilities ETF XLU has had a rough go of it the past two months! Below compares XLU to the S&P 500 over the past year-

Sometimes utilities are viewed as interest-sensitive assets. XLU was keeping pace with the S&P over the past year (sometimes ahead of it) until mid November last year, when they started heading south, backing off nearly 10% from the highs.

Below looks at the XLU over the past 18 years.

The recent softness in XLU is testing 9-year rising support at (2) above. Support is support until broken.

If XLU breaks support at (2), selling pressure could take place in this sector, which could mean that interest rates will move higher.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI