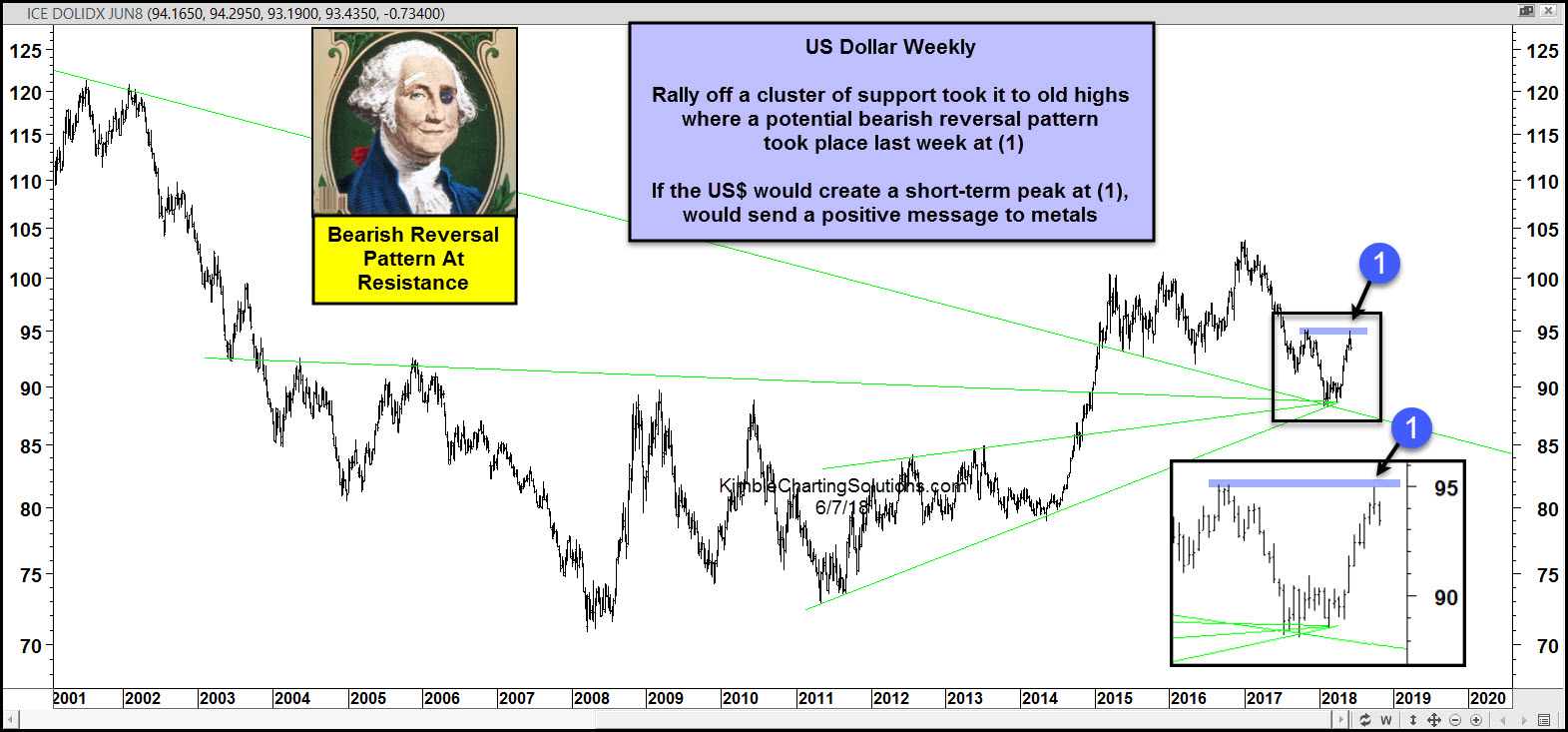

Several weeks back, we highlighted why the U.S. dollar might be due for a rally – and how this could slow the rise in precious-metals prices. The greenback was deeply oversold and testing a confluence of price support.

That support can be seen in today’s updated chart as well (see green lines).

Sure enough, the dollar put together a multi-week bounce that carried it up to the November 2017 highs before stalling out last week. That rally coincided with a pullback in precious-metals prices.

Bearish Reversal Pattern?

The November 2017 highs proved to be stiff resistance for the buck – USD literally stopped on a dime and reversed lower. Will this reversal mark another important turn?

If USD creates a short-term peak at point (1), it will send a positive message to precious metals. Stay tuned!

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI