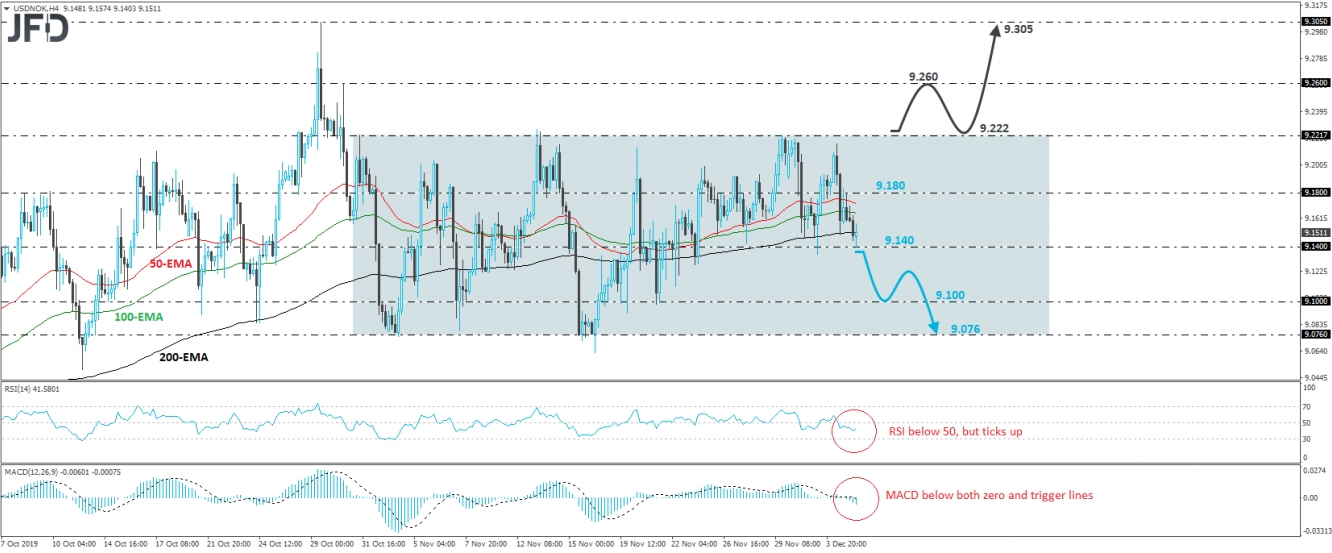

USD/NOK traded lower yesterday, after it hit resistance slightly below 9.222, which is the upper bound of a sideways range that’s been containing the price action since October 30th. Today, the rate hit support near 9.140 and then it rebounded somewhat. Although the range keeps the near-term outlook flat, given that the latest slide was initiated after the rate hit resistance near the range’s upper end, we see decent chances for more declines within the range.

If the bears are strong enough to take charge again soon and manage to overcome the 9.140 zone, we may then see the tumble extending towards 9.100, near the low of November 21st. If they are not willing to stop there either, a break lower may pave the way towards the 9.076 hurdle, which is the lower boundary of the aforementioned range.

Shifting attention to our short-term oscillators, we see that the RSI stands below 50, but has ticked up today, while the MACD lies below both its zero and trigger lines. Both indicators detect negative speed and support the notion for further declines. However, the RSI’s small uptick suggests that rate may rebound somewhat before the next negative leg.

On the upside, we would like to see a break above 9.222 before we start examining whether the bulls have gained the upper hand. This would signal the upside exit out of the sideways range and may initially aim for the peak of October 30th, at around 9.260. If that barrier is broken as well, then the advance could continue towards the high of the day before, at around 9.305.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.