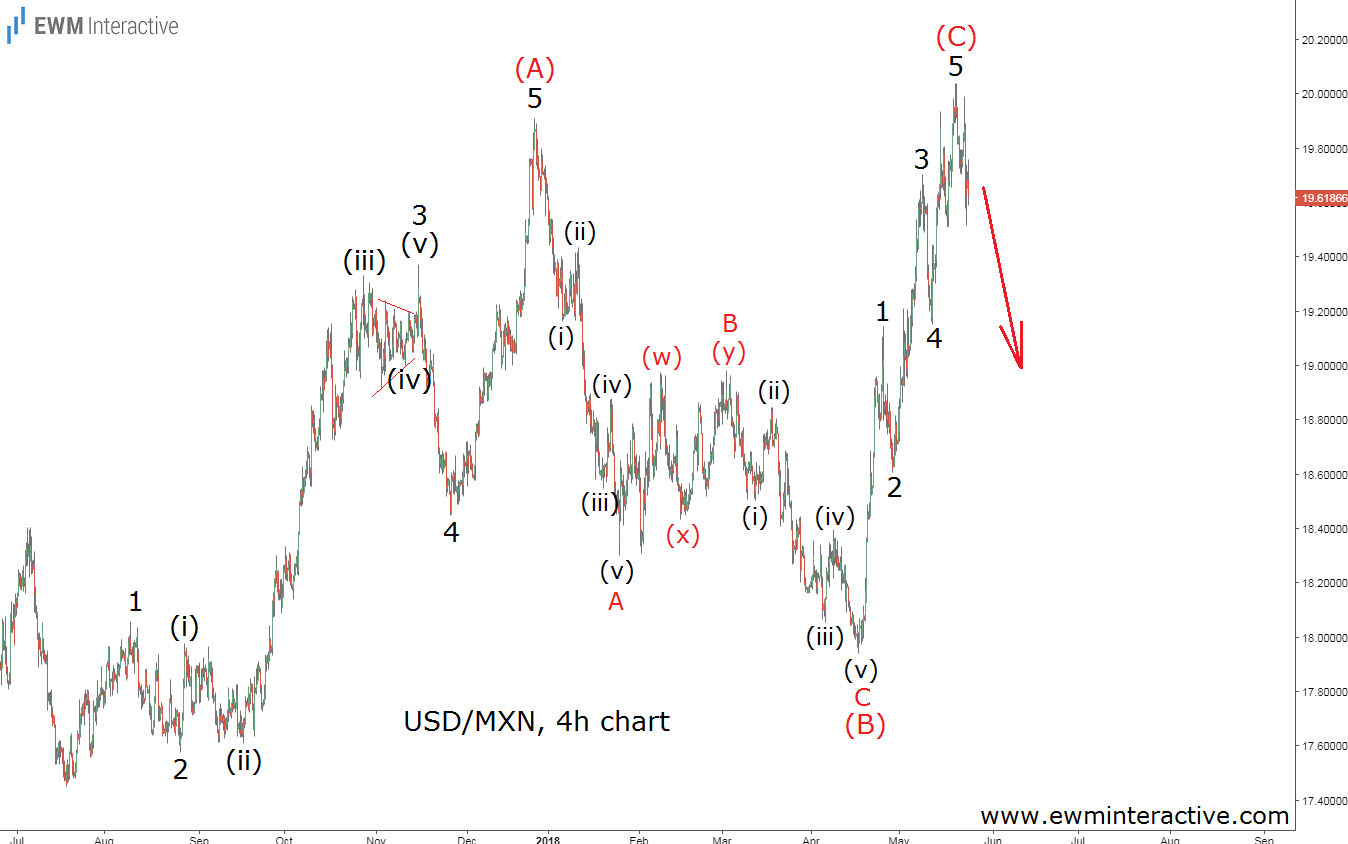

It has been almost four months since we last wrote about USD/MXN. On January 30th, the pair was hovering around 18.70, following a sharp selloff from 19.90 to 18.30. The good news was that instead of wondering what the Dollar-Mexican Peso exchange rate was going to do next, we managed to recognize a very reliable Elliott Wave pattern on the 4-hour chart of USD/MXN. It not only gave us a clue about the very next move, but actually put us ahead of the pair’s next three swings. Take a look at this chart to refresh your memory.

The pattern in question was a textbook five-wave impulse between 17.45 and 19.90, labeled 1-2-3-4-5 in wave (A), where the sub-waves of wave 3 were also clearly visible. According to the theory, impulses point in the direction of the larger pattern, but are also followed by a three-wave correction in the opposite direction. Since the decline from 19.90 to 18.30 was also impulsive, we concluded waves B up and C down of wave (B) still need to develop, before the bulls return to lift USD/MXN to the 20.00 mark in wave (C).

Of course, there was no way to predict what was going to happen in the world in the next four months. We did not even know it was going to take USD/MXN four months to complete the sequence. The pattern above provided all the information an Elliott Wave analyst needs.

Wave B of (B) took the pair to 18.98 on March 2nd. Then wave C caused the price to fall to as low as 17.94 on April 17th and put the entire three-wave decline in wave (B) to an end. The 5-3 wave cycle was complete and the door to 20.00 in wave (C) was wide open. A little over a month later – on May 21st – USD/MXN breached 20.03. Wave (C) is also an impulse, which makes the entire three-wave recovery from 17.45 look like a complete (A)-(B)-(C) zigzag. If this count is correct, the bulls would be better off staying aside as a notable bearish reversal might already be in progress.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.