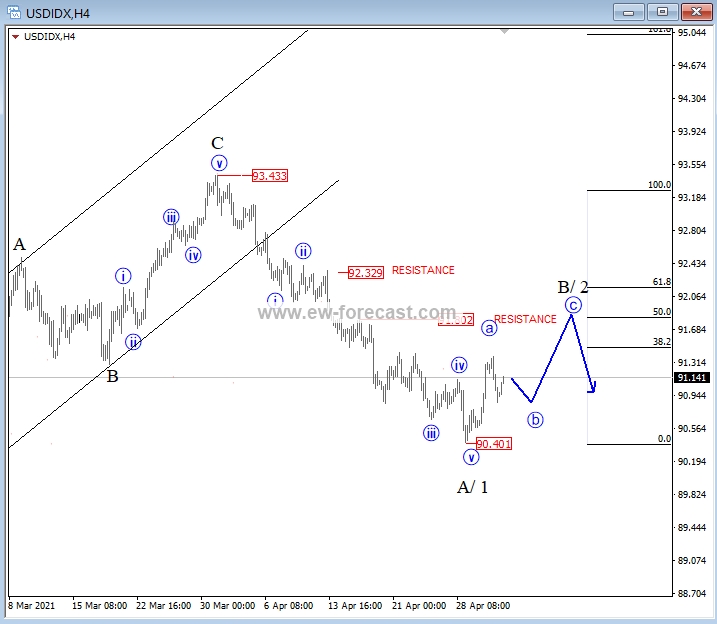

USD Index is coming down from 93.43 with five waves so we see that as a bearish structure that can make USD even weaker this month, but ideally after a three wave rally that can be now underway. Reason for some short-term recovery can be a recent turn up on US yields that remain strong despite no tapering by the FED.

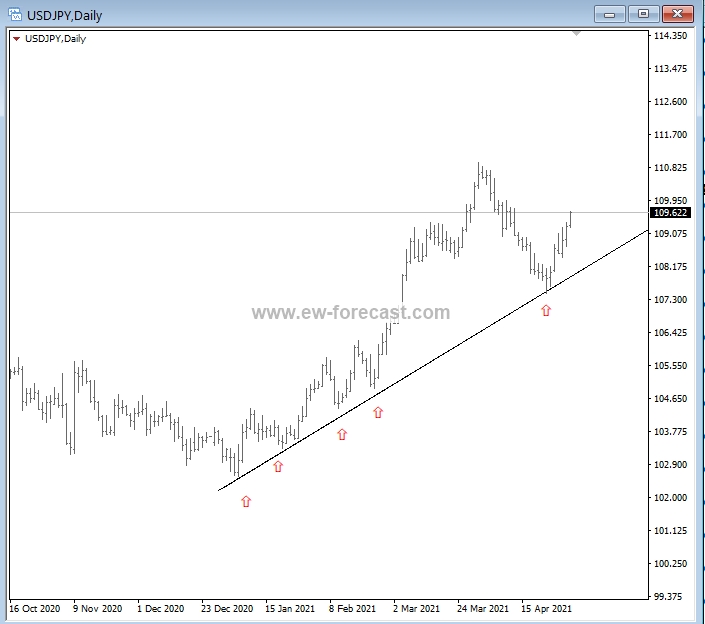

Notice that price broke above the trendline so bear market rally is here and it may find a resistance after a-b-c structure near 92.00 area. Invalidation level of the wave count is at 93.43. As long this market is in uptrend, we think that investors will try to pay atteniton to USD/JPY that is bouncing away from a rising trendline.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI