The news of the day is certainly the devaluation of the yuan by the renminbi, which send USD/CNY soaring. The chart below illustrates.

The daily chart looks atypical, but some other perspectives may shed a different light. When we look at the monthly chart, we see that this doesn't really break any key technical patterns. If we can get to the top of the channel -- around 6.40 in the next few months -- it will be interesting to see if a reversal emerges.

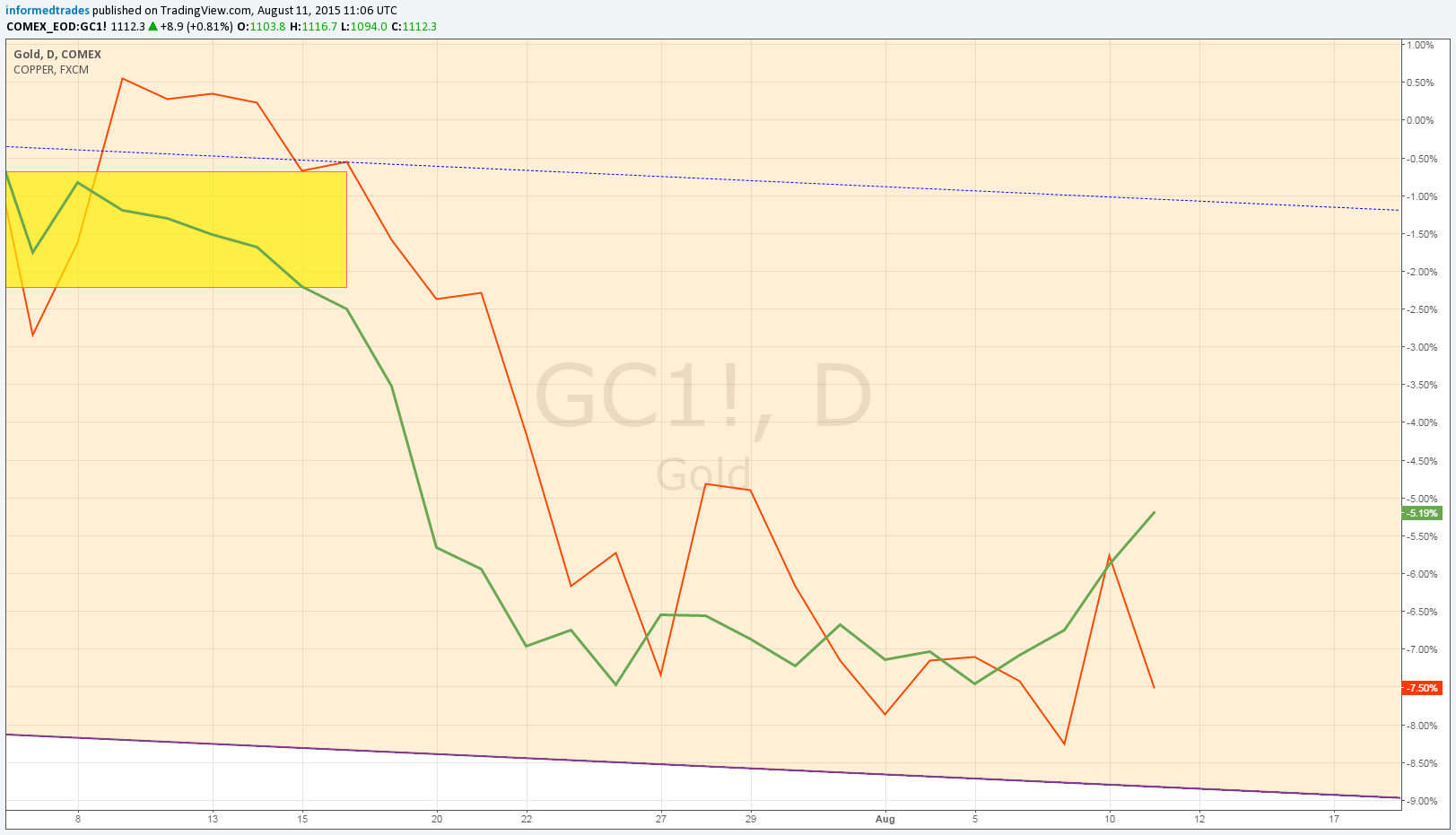

The devaluation does signal that the PBOC will be engaging in currency wars and further confirms the notion that the Chinese economy is slowing down. This could suggest commodity prices will remain declined. For what it's worth, we did see gold and copper diverge yesterday, with gold rising and copper declining. I'm not sure if this suggests how prices for precious metals (gold) will differ from base metals (copper) if a slowdown and devaluation persist in China, but I thought it was worth noting.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.