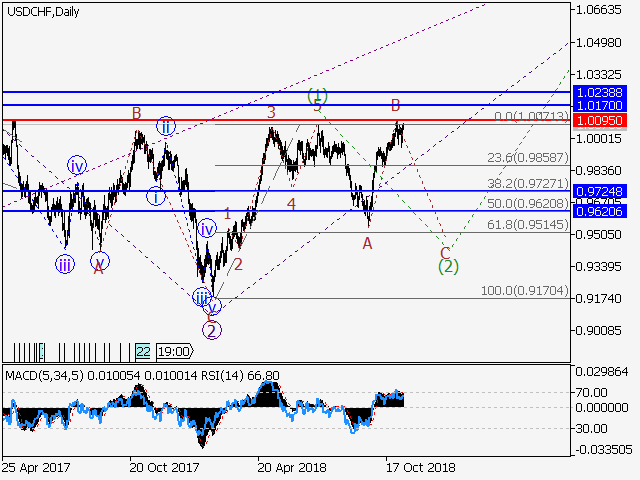

The pair USD/CHF is likely to fall in price. Estimated pivot point is at a level of 1.0095.

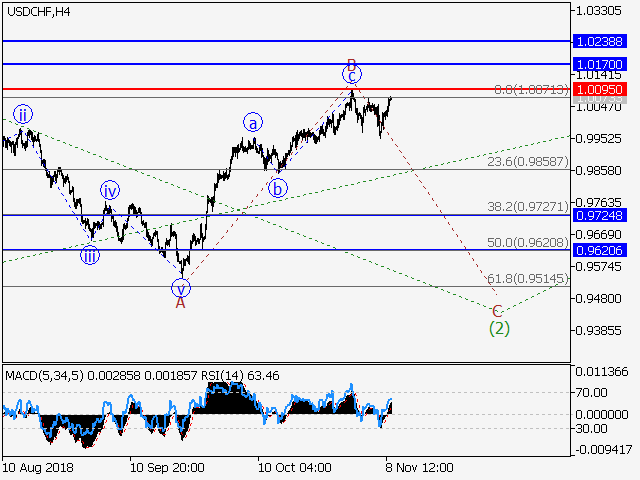

Main scenario: short positions will be relevant below the level of 1.0095 with a target of 0.9724 – 0.9620.

Alternative scenario: breakout and consolidation above the level of 1.0095 will allow the pair to continue the rise up to the levels of 1.0170 – 1.0238.

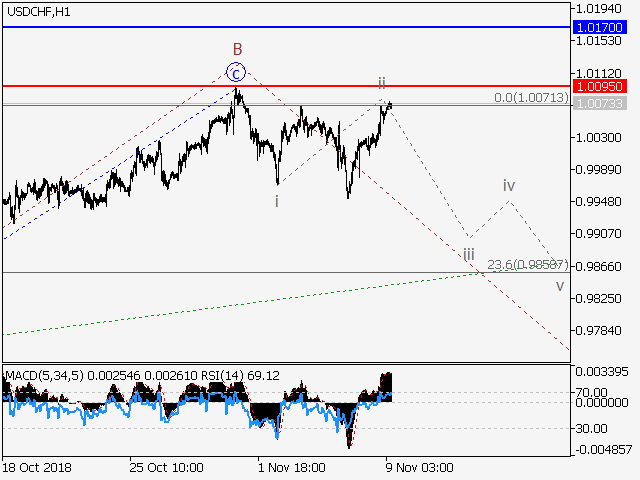

Analysis: The first wave of senior level 1 of (3) has been formed on the daily time-frame and the downward correction 2 of (3) is developing now. On the H4 time frame, the wave A of (2) has formed and presumably the local correction B of (2) finished developing. Apparently, the wave C of (2) started developing on the H1 time frame, with the waves of junior level i and ii formed inside. If the presumption is correct, the pair will logically drop to the levels 0.9724 – 0.9620. The level 1.0095 is critical in this scenario.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.