Stock market today: S&P 500 closer lower on fresh economic concerns

- USD/CHF reversed after hitting multi-week lows.

- Broke trendline, momentum signals turned neutral.

- Key resistance looms at .8333, support at .8200.

USD/CHF rebounded sharply on Tuesday, snapping its downtrend as the US dollar recovered and risk appetite surged on reports that Japan may cut ultra-long debt issuance. Swiss bond yields moved against the broader trend, suggesting some haven demand remains. However, with technicals flipping and key resistance in sight, directional risks in USD/CHF now appear more balanced near-term.

Japan Rumours Spark Long Bond Bid…

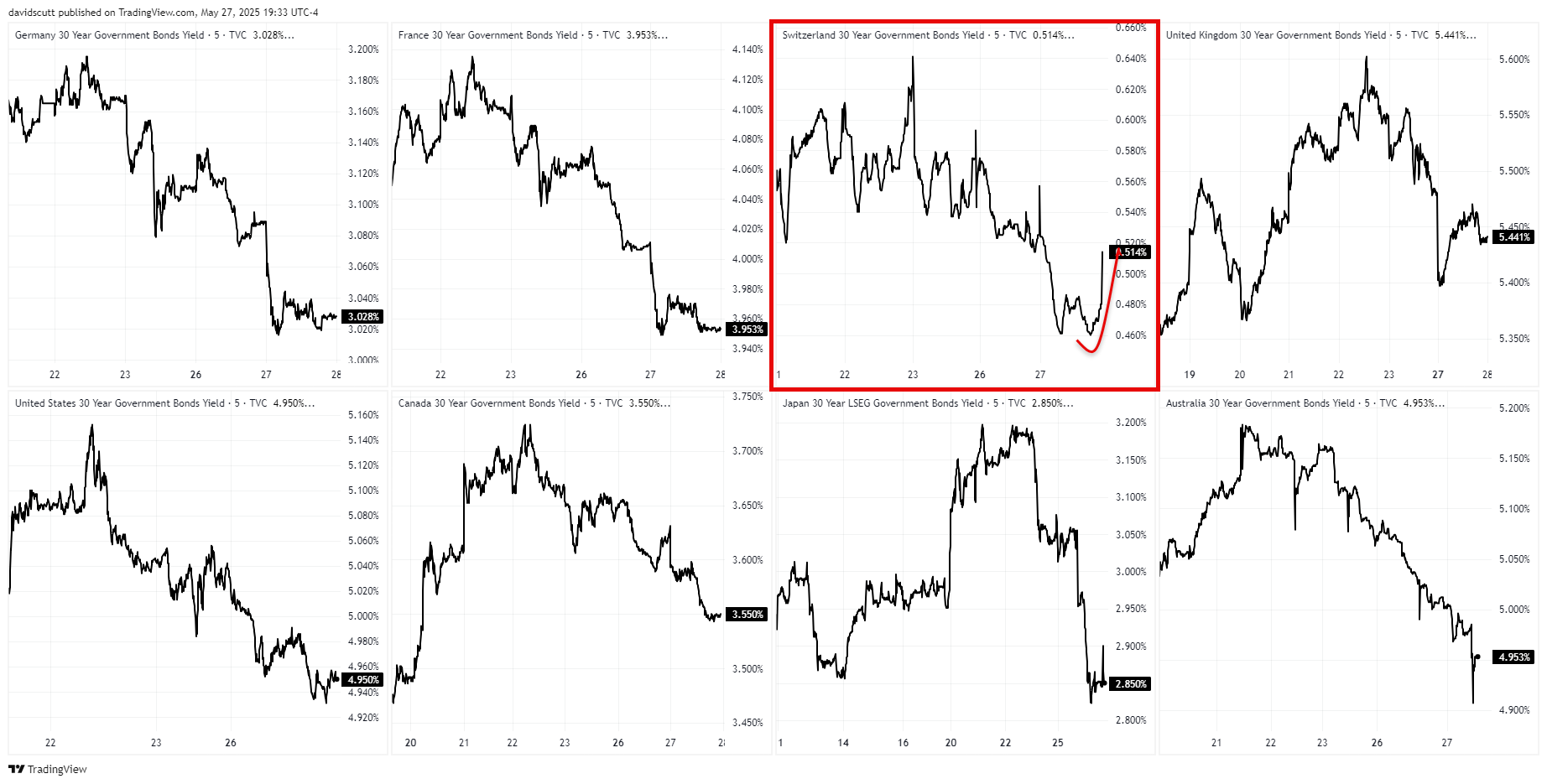

Longer-dated government bond yields across the developed world tumbled on Tuesday on rumours the Japanese government may curb issuance of ultra-long-dated debt. That helped spark a recovery in the U.S. dollar, not only as yield differentials moved in its favour but also by temporarily easing concerns around the U.S. debt trajectory.

Risk appetite ripped higher, adding to an already buoyant backdrop thanks to President Donald Trump’s latest tariff backflip—this time on 50% levies on EU imports that were due to kick in from June.

Source: TradingView

…Except in Switzerland

There was one exception to the rally in long-dated developed market debt: Switzerland. Instead of following the global lead, Swiss bond yields went the other way, hinting investors may have rotated into the safe haven to protect capital after the bloodbath in U.S. and Japanese debt markets earlier in the month.

With Japan showing the world how to temporarily lower longer-dated borrowing costs by hinting at reduced supply, it suggests demand for traditional havens like Swiss bonds—or the franc—may cool near-term if volatility continues to subside.

USD/CHF Shoots Higher

That could help explain the price action in USD/CHF on Tuesday. After briefly hitting multi-week lows, the pair reversed sharply, lifted by U.S. dollar strength stemming from both yen weakness and surging risk appetite. It not only broke its recent downtrend but also completed a three-candle evening star pattern, flagging potential upside risks.

Momentum signals have shifted neutral too, with RSI (14) breaking its downtrend and MACD crossing above the signal line—suggesting directional risks are now far more balanced than a day ago, favouring range trading near-term.

Source: TradingView

On the downside, bids may emerge around .8230, with stronger buying interest likely near .8200. On the topside, .8333 looms large, having been tested nine times from both directions in May but broken sustainably only twice. A close above could give bulls confidence to chase a run towards the 50-day moving average or the May 12 swing high at .8477.

As for what’s on the radar for USD/CHF this week, keep an eye on Japan’s 40-year bond auction on Wednesday, followed by U.S. 5-year and 7-year note sales over the next two days. The data calendar’s light until Friday, when April’s U.S. PCE inflation, spending and incomes figures are due. Resilience across the board would typically support the dollar, while weakness would likely weigh—so don’t just focus on inflation, the spending and incomes data will matter too.