USD/CAD lost ground this week reminds traders just how quickly things change in the Forex market. A week ago, on Friday 9th, the pair touched 1.2688. Five trading days later, the greenback is down to 1.2450 against the Canadian counterpart for a total loss of 238 pips or 1,88%. Higher inflation is considered as the primary reason for the US dollar weakness not only against the Loonie, but against other major rival currencies, as well.

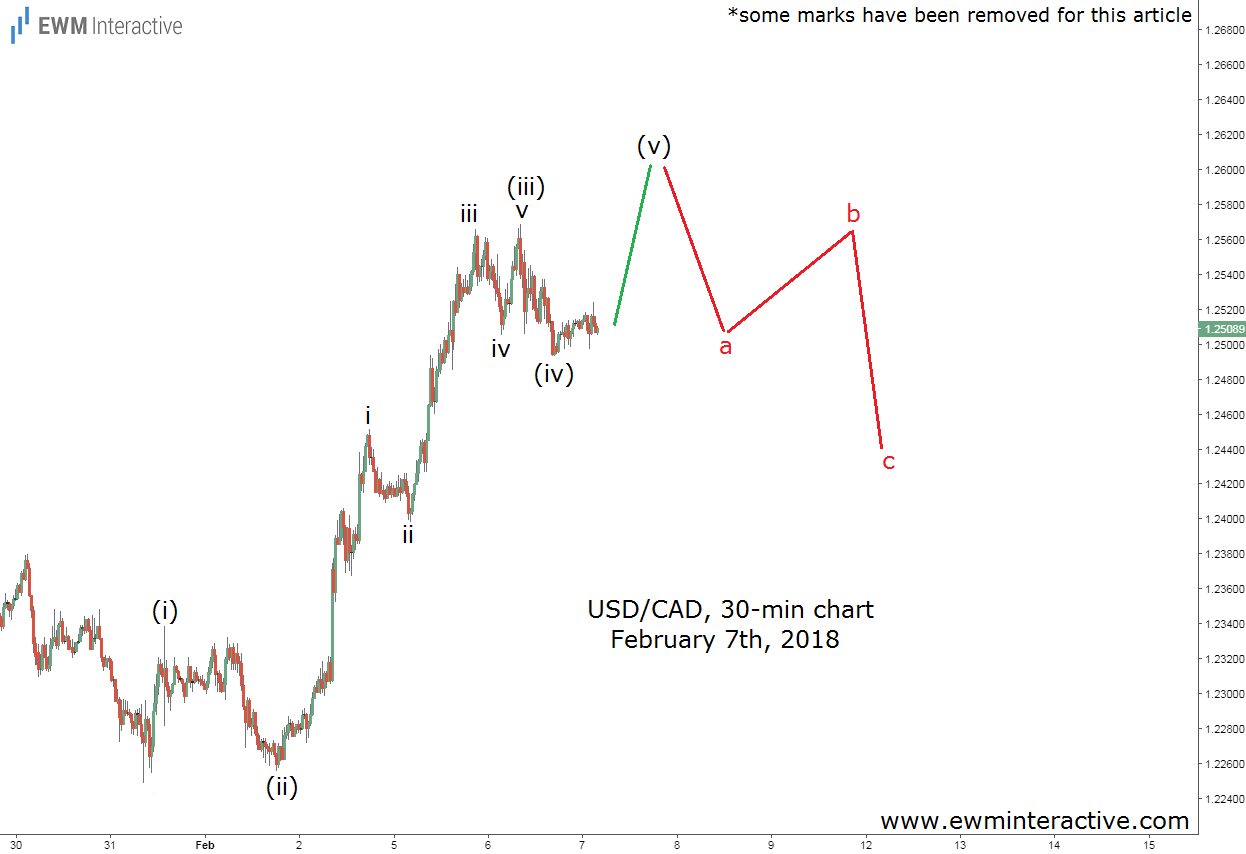

The bad news is you could hardly see it coming until Wednesday’s CPI report. The good news is that with the help of Elliott Wave analysis, traders could anticipate and prepare for the market’s reaction to such news. The chart below was included in the mid-week updates sent to clients on February 7th, putting them an entire week ahead of USD/CAD’s recent developments.(some marks have been removed for this article)

In the middle of last week, the pair was hovering around 1.2510, but given the bigger picture outlook, we thought the recovery from the low at 1.2248 was supposed to evolve into a five-wave impulse. By February 7th, its fifth wave was still missing, which meant “wave (v) should lift the pair to 1.2600.”

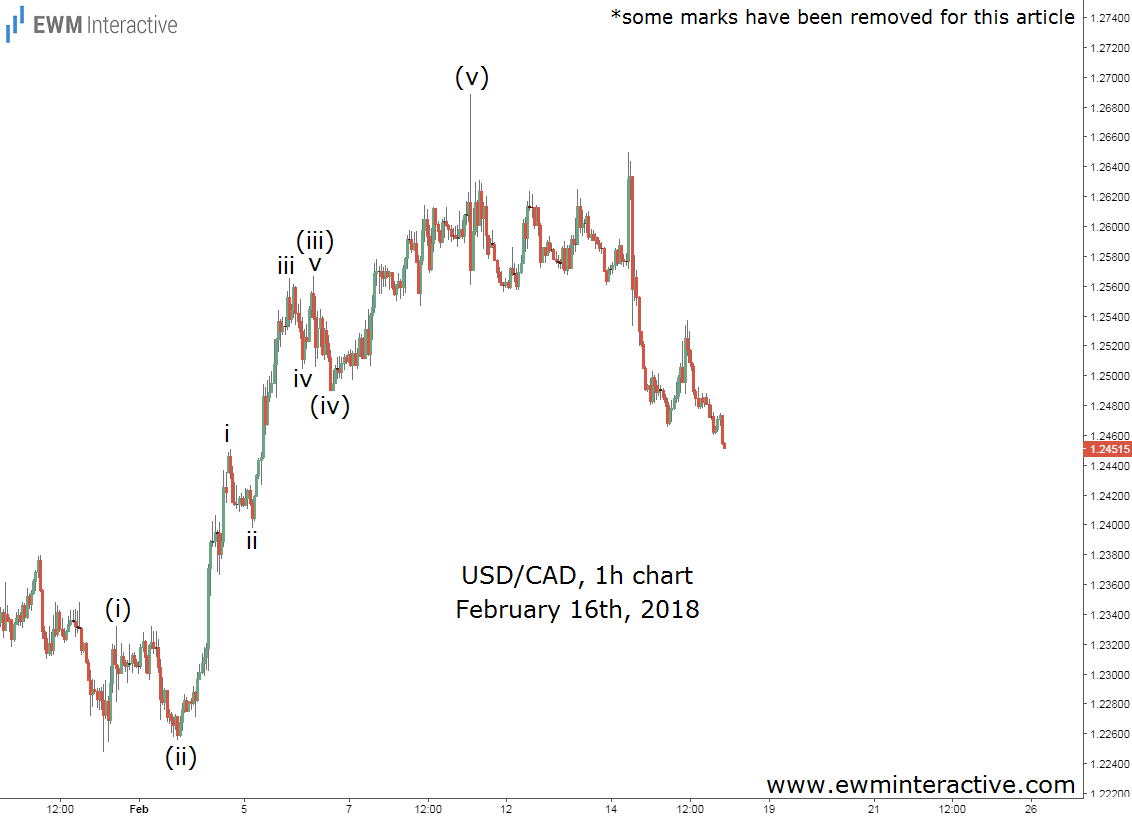

On the other hand, the Elliott Wave Principle states that every impulse is followed by a three-wave correction in the opposite direction. So instead of joining the bulls when USD/CAD breached 1.2600 the next day, we were already getting ready for a bearish reversal. As the updated chart below shows, it did not take long for the bears to return.

The pair exceeded 1.2600 and climbed to almost 1.2700 on Friday, but that did not change the wave count in a material way. A week later today, USDCAD trades near 1.2460, allowing the large army of news analysts to explain the plunge with the increased inflation expectations. Elliott Wave analysts, fortunately, do not have to waste time wondering what caused what, because to us, USD/CAD’s decline is just a natural three-wave pullback of the preceding impulsive sequence.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.