Nvidia shares jump after resuming H20 sales in China, announcing new processor

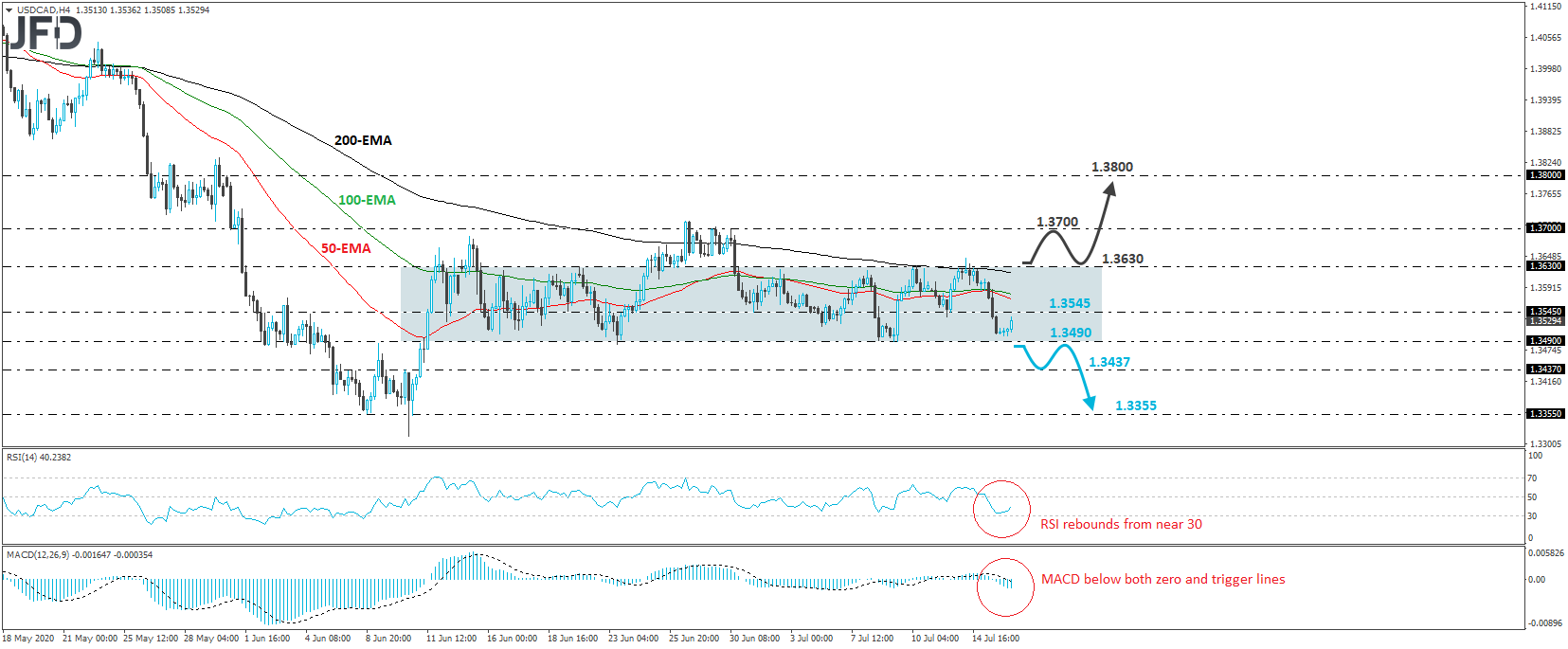

USD/CAD traded somewhat higher on Thursday, after it hit support slightly above the 1.3490 key barrier. That hurdle appears to be the lower end of a sideways range that’s been containing most of the price action since June 11th, with the upper bound being at 1.3630. As long as the pair continues to trade in between those two boundaries, we would consider the short-term outlook to be flat.

Despite yesterday’s decent slide, in order to get confident on more bearish extensions, we would like to see a strong break below 1.3490. This move would confirm a forthcoming lower low and may initially pave the way towards the inside swing high of June 10th, at around 1.3437. If the bears are not willing to stop there, then a break lower could trigger extensions towards the 1.3355 area, marked by the lows of June 8th and 9th.

Shifting attention to our short-term oscillators, we see that the RSI rebounded from near its 30 line, while the MACD, although below both its zero and trigger lines, shows signs that it could also start bottoming. These indicators detect slowing downside speed and suggest that some further recovery, within the range, may be possible before, and if, traders decide to attempt an exit.

That said, we would start examining the bullish case, only if we see the rate breaking above 1.3630. Such a move could encourage advances towards the high of June 30th, at 1.3700, the break of which may allow the bulls to put the 1.3800 zone on their radars. That zone provided strong resistance back on May 31st.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.