The Canadian dollar is showing little movement in the Friday session. Currently, USD/CAD is trading at 1.2655, down 0.13% on the day. On the release front, Canada releases key consumer data. CPI is expected to dip to 0.4%. Core Retail Sales and Retail Sales are also forecast to post gains of 0.4%. There are no US data releases on the schedule.

There were no surprises from the Bank of Canada on Wednesday, as the bank maintained the benchmark rate at 1.25 percent. The BoC was in cautious mode in the rate statement, noting that growth in the first quarter was weaker than the bank had forecast, but that it expected better news in the second quarter. The bank has some egg on its face, as in January it predicted growth of 2.5% for the first quarter, but has now revised the forecast to just 1.3% growth. Speaking after the statement, BoC Governor Stephen Poloz said that “the economy is in a good place,” but added that “interest rates are very low”. This is a clear signal that the BoC plans to raise rates in the near future, and many analysts are predicting a rate hike in July. Canada’s employment picture has been a bright spot, underscored by an excellent ADP nonfarm payrolls report on Thursday. As well, inflation has moved closer to the BoC’s target of 2 percent, making a rate hike likely in the next few months.

Continuing uncertainty over the future of the NAFTA trade agreement remains a major headache for the Bank of Canada. The protectionist US administration has reopened the NAFTA agreement, threatening to walk away if its demands for major concessions in favor of the US are not met. NAFTA is a crucial component of the Canadian economy, and the loss of NAFTA would be a nightmare for Canada. Ideally, the bank would prefer to hold off on a rate hike until the NAFTA issue is resolved. At the same time, the Federal Reserve is expected to raise rates at least twice more in 2018, and if the BoC does not increase rates, the Canadian dollar could fall sharply against a US currency that would be more attractive to investors.

USD/CAD Fundamentals

Friday (April 20)

- 8:30 Canadian CPI. Estimate 0.4%

- 8:30 Canadian Core Retail Sales. Estimate 0.4%

- 8:30 Canadian Retail Sales. Estimate 0.4%

- 8:30 Canadian Common CPI

- 8:30 Canadian Median CPI

- 8:30 Canadian Trimmed CPI

- 8:30 Canadian Core CPI

- 11:15 US FOMC Member John Williams Speaks

*Key events are in bold

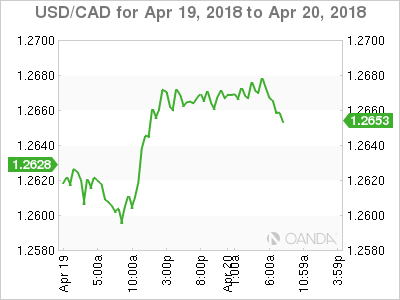

USD/CAD for Friday, April 20, 2018

USD/CAD, April 20 at 7:40 DST

Open: 1.2672 High: 1.2686 Low: 1.2656 Close: 1.2655

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2397 | 1.2496 | 1.2590 | 1.2687 | 1.2757 | 1.2850 |

USD/CAD was flat in the Asian session and is showing limited trade in European trade

- 1.2590 is providing support

- 1.2687 is under pressure in resistance

- Current range: 1.2590 to 1.2687

Further levels in both directions:

- Below: 1.2590, 1.2496 and 1.2397

- Above: 1.2687, 1.2757 and 1.2850

OANDA’s Open Positions Ratio

USD/CAD ratio continues to show limited movement this week. Currently, long positions have a majority (58%), indicative of USD/CAD continuing to head lower.