USD/CAD is unchanged in the Monday session. Currently, USD/CAD is trading at 1.3384, down 0.01% on the day. On the release front, there are no major events on the schedule. Canadian Foreign Securities Purchases is expected to dip to C$6.20 billion. In the U.S., the Empire State Manufacturing Index is expected to drop to 20.1 points. On Tuesday, Canada releases manufacturing sales and the U.S publishes building permits and housing starts.

The Canadian dollar continues to struggle. The currency has declined for four straight weeks, dropping 1.8% in that time. Weaker oil prices and a slowdown in the U.S. are weighing on the Canadian economy and the export sector is being hampered by the ongoing U.S-China trade war. The Bank of Canada is expected to respond by scaling back rate hikes. The bank has raised rates three times this year, but stayed on the sidelines at the December meeting. With the Federal Reserve expected to raise rates just once or twice in 2019, there will be less pressure on the BoC to raise rates.

As expected, retail sales were down sharply in November. Core retail sales dropped from 0.7% to 0.2%, while U.S. retail sales declined to 0.2%, down from 0.8%. Still, retail sales managed to beat the estimate of 0.1%. Lower oil prices have boosted consumer spending, which is expected to look strong in the fourth quarter. Inflation has dipped of late, CPI dropped to 0.0% in November, down from 0.3% a month earlier. This marked the lowest level since May. Core CPI remained pegged at 0.2 percent. The weak readings can be attributed to falling oil prices, which has led to a sharp decline in gasoline prices. On an annualized basis, inflation gained 2.2 percent in November, down from 2.5 percent in October.

USD/CAD Fundamentals

Monday (December 17)

- 8:30 Canadian Foreign Securities Purchases. Estimate 6.20B

- 8:30 US Empire State Manufacturing Index. Estimate 20.1

- 10:00 US NAHB Housing Market Index. Estimate 61

- 16:00 US TIC Long-Term Purchases

Tuesday (December 18)

- 8:30 Canadian Manufacturing Sales. Estimate 0.3%

- 8:30 US Building Permits. Estimate 1.27M

- 8:30 US Housing Starts. Estimate 1.23M

*All release times are EST

*Key events are in bold

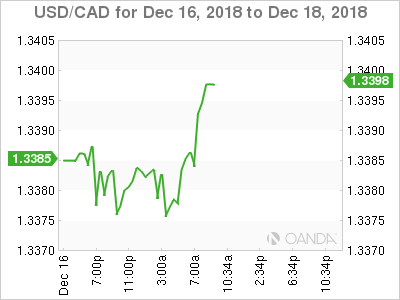

USD/CAD for Monday, December 17, 2018

USD/CAD, December 17 at 8:00 EST

Open: 1.3385 High: 1.3391 Low: 1.3373 Close: 1.3384

USD/CAD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3198 | 1.3292 | 1.3383 | 1.3461 | 1.3552 | 1.3696 |

USD/CAD posted small gains in Asian trade and this trend has continued in the European session

- 1.3383 was tested earlier in support and is a weak line

- 1.3461 is the next resistance line

- Current range: 1.3383 to 1.3461

Further levels in both directions:

- Below: 1.3383, 1.3292, 1.3198 and 1.3099

- Above: 1.3461, 1.3552 and 1.3696