USD/CAD closed at 1.3028 on Friday, February 3rd, continuing the decline from 1.3387, which began in mid-January. So, if you have been expecting more weakness this week, nobody can blame you. After all, trading in the direction of the trend is a viable strategy. However, even the strongest trend is interrupted by an occasional correction from time to time. If the trader happens to join the trend just before the start of one of these corrections, poor results are almost guaranteed. So the question is how to anticipate a correction?

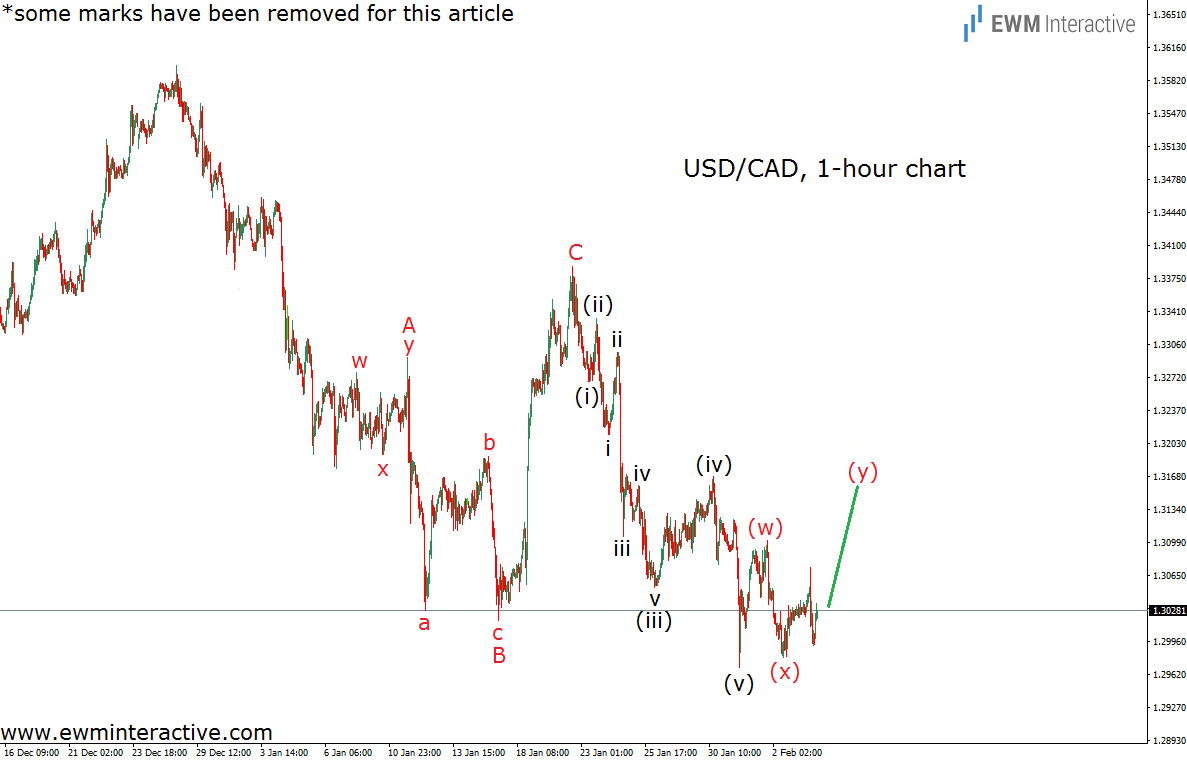

The way we do it is by applying the Elliott Wave Principle to the price chart of the instrument in question. For example, the hourly chart of USD/CAD below has been sent to our premium clients before the markets opened on Monday, February 6th (some marks have been removed for this article).

As visible, the decline between 1.3387 and 1.2969 has been identified as a five-wave impulse. According to the theory, every impulse is followed by a correction in the opposite direction, consisting of three waves. In USD/CAD’s case, the third wave – (y) up – was still missing, so we thought the pair’s next stop should be the resistance area of wave (iv) near 1.3160. Today is Thursday and we can already see how that forecast played out.

The Canadian dollar started rising right away on Monday. The very next day, it exceeded the initial bullish target and climbed to as high as 1.3212 or nearly 200 pips above last week’s close. Many might be wondering what caused the surge, but to wave analysts there was nothing surprising about it. All the market did was to follow the Wave Principle’s rules and complete the three-wave recovery.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI