Stock market today: S&P 500 falls as inflation, mixed bank earnings weigh

Good morning. Hope all is well! We have had a really good forecast for yesterday with 6 out of the 7 pairs behaving as predicted. The only odd pair was NZD/USD that didn’t reach our demand zone. The US dollar was overall sidelined while the Japanese yen lost a little steam and weakened by a point on our scale. Today we have many fundamental news items coming out that could effect most major trading currencies. US dollar, Canadian dollar, euro, British pound and Japanese yen are in on the party and we could see significant movements on them. We could be in for strong US and the Japanese yen may let out some steam. Not adding any hedged pairs to offset the trading risk. Happy Trading!

Forecasts Outlook

US Dollar: Strong

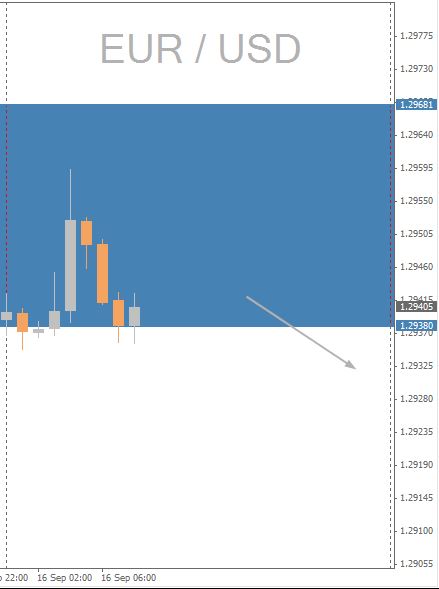

Today we're expecting the EUR/USD to proceed Short below the barrier levels of 1.29380 and 1.29681.

Fundamental Watch

– Monetary Policy Meeting Minutes

– BOJ Gov Kuroda Speaks

– CPI y/y

– German ZEW Economic Sentiment

– Manufacturing Sales m/m

– PPI m/m

– BOC Gov Poloz Speaks

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.