Nvidia shares jump after resuming H20 sales in China, announcing new processor

Talking Points

- Correction or reversal in EUR/USD?

- GBP/USD rebounds after critical technical break

- USD/JPY showing signs of fatigue

Foreign Exchange Price & Time at a Glance:

Charts Created using Marketscope – Prepared by Kristian Kerr

- EUR/USD traded to its lowest level in over two years last week before rebounding aggressively yesterday from just above 1.2500

- Our near-term trend bias is lower while below the 2nd square root relationship of the year’s low near 1.2725

- Interim support is eyed at 1.2500, but the next key downside attraction looks to be the 78.6% retracement of the 2012/2014 range near 1.2455

- A turn window of some importantance is eyed later this week

- A close over 1.2725 would turn us positive on the euro

USD/JPY Strategy: Like holding reduced long short positions while below 1.2725

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

*1.2455 |

1.2500 |

1.2600 |

1.2675 |

*1.2725 |

Charts Created using Marketscope – Prepared by Kristian Kerr

- GBP/USD fell to its lowest level since November of last year late last week

- Our near-term trend bias is lower in cable while below 1.6205

- A close back under 1.6000 is needed to signal a resumption of the decline

- A minor turn window is eyed later this week

- A close over the 2nd square root relationship of the year’s low near 1.6205 would turn us positive on Cable

GBP/USD Strategy: Like holding reduced short position while below 1.6205.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

1.5880 |

*1.6000 |

1.6055 |

1.6085 |

*1.6205 |

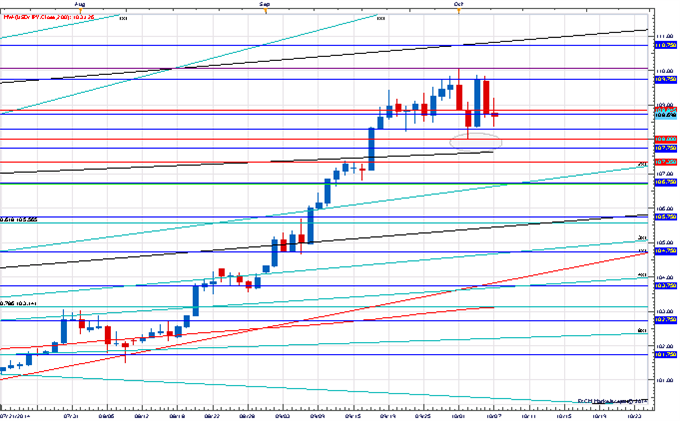

USD/JPY bounced smartly off the 2nd square root relationship of the year’s high near 108.00 last week. The 2nd square root relationship is critical in the way we look at things as corrections tend to get sloppy and much more complex below this level. While USD/JPY remains above 108.00 we have to favor the upside, but the rate’s failure to push to new highs following the recovery off 108.00 is more than a little concerning as the psychology is now in place for some kind of top. A close over 109.75 or a push through 110.10 is needed to alleviate our concerns while a break under 108.00 would turn us overtly negative on the pair.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI