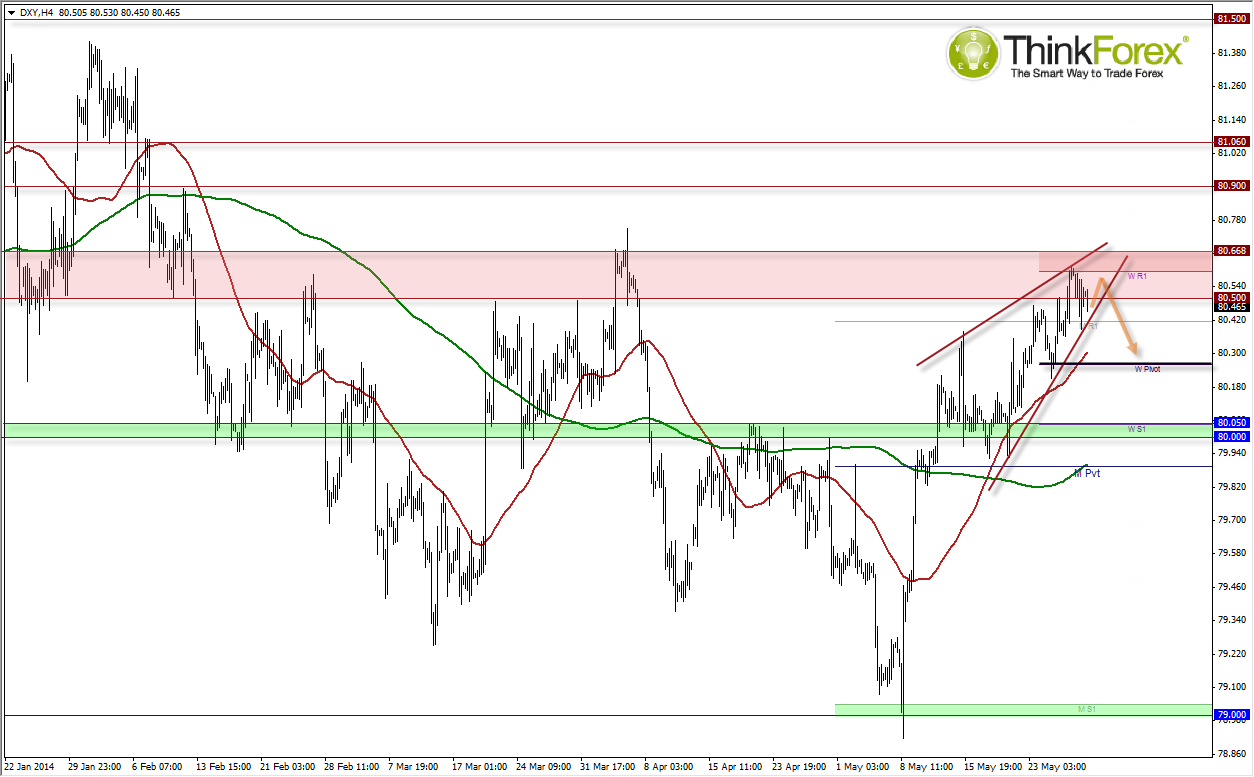

With yesterday's Hanging Man Reversal forming as part of a potential Bearish Wedge under resistance, my bias is for a bearish reversal leading up to next week's key events.

SUMMARY

- USD INDEX has been rising on lower volumes and stalled at resistance zone

- Potential bearish wedge forming beneath resistance zone

- Hanging Man reversal (and inside day) warns of pending weakness

- Revesal candles formed on D1 across major pairs

- Bias is for a USD bearish retracement leading upto ECB rates and NFP

Prior the upside break caused by the weaker Euro, the USD Index had been rising gradually on thinning volume. Due to the offloading of Euros we saw DXY break the 80.50 barrier but remain under the 80.60 resistance, and I now suspect price is coiling up within a Bearish Wedge pattern. Yesterday closed with a Hanging Man inside day to suggest near-term weakness, or sideways trading.

Also when I look across the Major Pairs they are littered with near-term reversal candles such as Hanging Men, Riskshaw Man Doji's or Shooting Stars etc. This adds extra weight to the DXY retracement and for intraday traders to profit from selling the greenback.

The two main events next week will be from ECB rate decision and Friday's Nonfarms payroll. These combined could indeed create some volatile moves and hopefully more directional than just pure mayhem and whipsaws. Should the ECB cut rate then we can expect some severe offloading of Euros which would push USD Index higher (as Euro accounts for 57% of the Index weighting). Couple this with excellent jobs figures and we could see lift-off for the US Index.

However until then, leading up to these 2 main events, my bias remains a pullback for USD.