The Canadian dollar has edged lower in the Monday session. In North American trade, USD/CAD is trading at the 1.35 line. Canadian banks and stock markets are closed for the Victoria Day holiday. In the US, there are no economic releases. We’ll hear from four FOMC members, and the markets will be looking for clues as to the Fed’s plans with regard to future rate hikes. On Tuesday, Canada releases Wholesale Sales and the US will publish New Home Sales.

There are no economic numbers out of Canada or the US on Monday, so the markets will have a chance to focus on the Federal Reserve, with four FOMC members delivering speeches. The Fed has been keeping the markets guessing in recent weeks regarding a rate hike. The central bank is expected to announce a rate hike at its June 14 meeting, but the odds of a hike have shown strong volatility. In late April, a rate hike was priced in at just 50%. The odds jumped higher in May but continue to show movement.

Currently, the markets have priced in a hike at 78%, up from 73% on Friday. If the likelihood of a June move continue to fluctuate, the US dollar could also show some movement, as a rate hike will make US-dollar assets more attractive to investors.

The Canadian dollar enjoyed strong gains last week, as the currency climbed 1.4%. Although Canadian consumer numbers were lukewarm last week, the Canadian dollar was buoyed by rising oil prices, as Brent crude soared 4.7% last week. However, investors are nervous about the ongoing political turmoil in Washington, and that could spell trouble for minor currencies like the Canadian dollar. President Trump must have been happy to head to the Middle East and Europe, as last week was perhaps his most difficult since taking office.

Trump’s administration was rocked by reports that he had asked former FBI director James Comey to end an investigation into connections between Russia and the Trump campaign team during the US election. If these claims are true, Trump could be charged with committing obstruction of justice. President Trump fired back last week, angrily denouncing this move as a “witch hunt”. With Washington preoccupied with Trump’s alleged connections with Russia, Trump’s administration could find itself immersed with damage control, rather than moving ahead with its agenda of tax reform and increased fiscal spending.

USD/CAD Fundamentals

Monday (May 23)

- 10:00 FOMC Member Patrick Harker Speaks

- 10:30 FOMC Member Neel Kashkari Speaks

- 19:00 FOMC Member Lael Brainard Speaks

- 21:10 FOMC Member Charles Evans Speaks

Tuesday (May 24)

- 8:30 Canadian Wholesale Sales. Estimate 1.1%

- 10:00 US New Home Sales. Estimate 611K

*All release times are EDT

*Key events are in bold

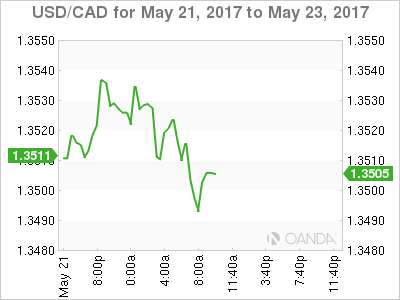

USD/CAD for Monday, May 22, 2017

USD/CAD Monday, May 22 at 9:00 EDT

Open: 1.3511 High: 1.3541 Low: 1.3485 Close: 1.3492

USD/CAD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.3212 | 1.3351 | 1.3457 | 1.3551 | 1.3648 | 1.3757 |

EUR/USD was flat in the Asian session and has posted small losses in the European and North American sessions

- 1.3457 is providing support

- 1.3551 is the next line of resistance

Further levels in both directions:

- Below: 1.3457, 1.3351 and 1.3212

- Above: 1.3551, 1.3648 and 1.3757

- Current range: 1.3457 to 1.3551

OANDA’s Open Positions Ratio

In the Monday session, USD/CAD is showing short positions with a majority (64%). This is indicative of USD CAD reversing directions and moving lower.