Talking Points:

- USD/CAD Technical Strategy: Flat

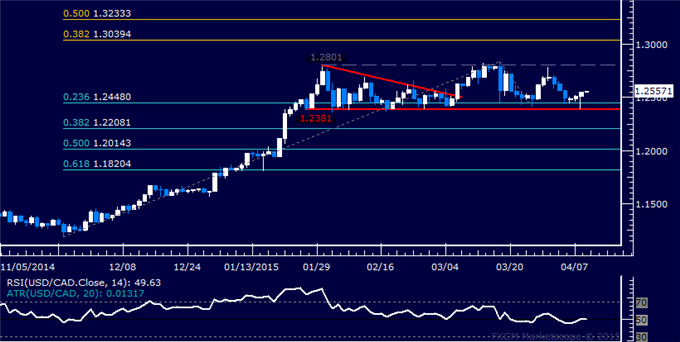

- Support: 1.2381, 1.2208, 1.2014

- Resistance: 1.2801, 1.3039, 1.3233

The US dollar continues to consolidate above range support near the 1.24 figure against its Canadian counterpart. Near-term support is in the 1.2381-2448 area (January 27 low, 23.6% Fibonacci retracement), with a break below that on a daily closing basis exposing the 38.2% level at 1.2208. Alternatively, a turn above the January 30 high at 1.2801 opens the door for a challenge of the 38.2% Fib expansion at 1.3039.

Positioning is inconclusive at this point, with prices offering no clear-cut and actionable signal to initiate a long or short trade. We will continue to remain on the sidelines for the time being, waiting for a compelling opportunity to present itself.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI