Chinese chip stocks jump as Beijing reportedly warns against Nvidia’s H20

Talking Points

- USD/CAD Technical Strategy: Longs Preferred

- Absence of Reversal Signals May Open Further Gains

- Sights Turn To 2014 High Following Breach Of 1.11

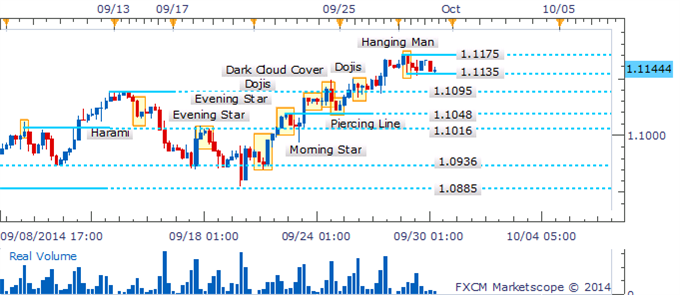

USD/CAD’s ascent has encountered some turbulence which may prove transitory with a void of bearish reversal signals in its wake. This keeps the 2014 high near 1.1270 in focus. A slide back under the 1.1100 barrier would be required to warn of a correction for the pair.

USD/CAD: Loses Steam After Leaping Over 1.1100 Hurdle

The four hour chart reveals some ‘messy’ intraday price action within the 1.1135 and 1.1175 trading band. While a Hanging Man had warned of a potential correction, it failed to find significant follow-through. This leaves a break of the recent range desired in order to offer a clearer directional bias.

USD/CAD: Awaiting Break From Intraday Congestion

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.