Talking Points

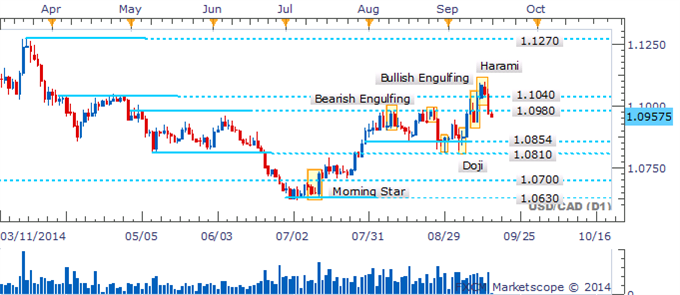

- USD/CAD Technical Strategy: Sidelines Preferred

- Harami Confirmation Suggests Declines May Continue

- “False Breakout” Casts Risks Lower To 1.0854

USD/CAD has been sent reeling following the emergence of a Harami pattern on the daily. The key reversal pattern and daily close below the 1.0980/1.1000 barrier warn of further short-term weakness for the pair. Yet within the context of a longer-term uptrend a pullback to the 1.0854 floor would be seen as a buying opportunity at this stage.

USD/CAD: Harami Delivers Drop Below “Breakout” Point

The four hour chart reveals an absence of bullish reversal signals at this stage. This suggests the chances of an intraday recovery may be slim. A continued correction is likely to be met by buying interest at the 1.0936 floor.

USD/CAD: Recovery Hopes Appear Slim Amid Void of Bullish Candlesticks

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.