Novo Nordisk cuts full-year sales and profit guidance, stock plunges

Talking Points

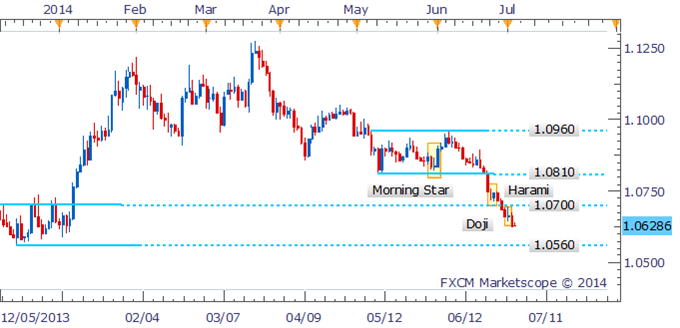

- USD/CAD Technical Strategy: Shorts Preferred

- Absence of reversal signals casts doubt on bounce

- December 2013 lows near 1.0560 in focus

USD/CAD has broken below the critical 1.0700 handle after a Harami pattern on the daily failed to find confirmation. With bullish signals now absent, doubt is cast on a possible recovery for the pair. The daily close below 1.0700 paves the way for a decline to the 1.0560 mark.

Daily Chart - Created Using FXCM Marketscope 2.0

An examination of the four hour chart reveals a Bearish Engulfing pattern near 1.7000 which signaled USD/CAD was set to resume its downward trajectory. With key reversal patterns absent in intraday trade a recovery appears doubtful.

4 Hour Chart - Created Using FXCM Marketscope 2.0

By David de Ferranti, Market Analyst, DailyFX

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.