Grok 4 is here and analyst says ’don’t bet against Elon’

Talking Points

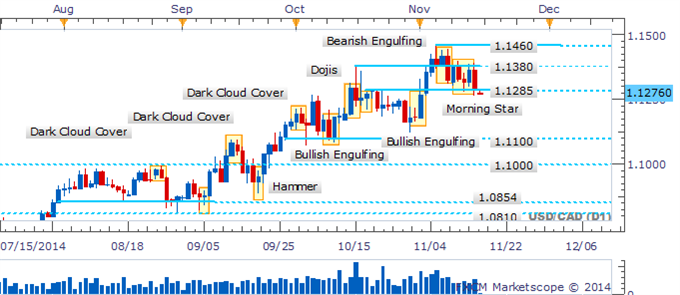

- Strategy: Long (1.1280), Target: 1.1460, Stop 1.1270 (Daily Close)

- Morning Star Formation Fails To Find Confirmation

- H4 Chart Shows Reluctance From The Bears In Intraday Trade

USD/CAD is at a critical juncture as it probes below the 1.1280/5 barrier in intraday trade. The recent pullback has left a Morning Star formation lacking confirmation. However, the presence of a core uptrend (albeit an extremely choppy one) remains. This suggests a further retreat is questionable and may warrant a ‘buy the dip’ approach. Traders should be mindful of the pair’s tendency towards violent intraday whipsaws meaning caution is required when looking to adopt fresh positioning.

USD/CAD: Pullback To Key Support Region Negates Bullish Signal

The four hour chart demonstrates significant reluctance from the bears to drag the pair lower. This is signaled by a medley of Dojis and short body candles. Yet at this stage more definitive bullish reversal signals remain absence.

USD/CAD: Doji & Short Body Medley Demonstrates Reluctance From The Bears