Dow falls seventh session in a row

US stocks bounced back on Wednesday despite further accusations by Trump administration late Tuesday China is waging a systematic campaign of “economic aggression.” The S&P 500 recovered 0.2% to 2767.32. The Dow Jones Industrial Average however extended losses seventh straight session, slipping 0.2% to 24657.80. NASDAQ Composite index rose 0.7% to 7781.51. The dollar strengthening continued: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, edged up 0.1% to 95.10 and is higher currently. Stock index futures point to higher openings today.

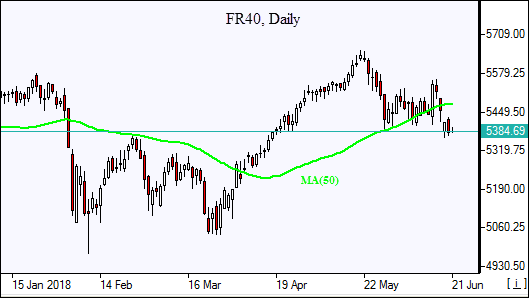

European stocks rebound

European stock indices recovered on Wednesday despite the European Union announcement it would implement tariffs on €2.8 billion worth of goods imported from the US on Friday. The euro continued the slide against the dollar while British Pound ended little changed and both are falling currently. The Stoxx Europe 600 rose 0.3%. Germany’s DAX 30 added 0.1% to 12695.16. France’s CAC 40 however fell 0.3% while UK’s FTSE 100 gained 0.3% to 7627.40. The Bank of England is expected to hold policy steady at a meeting today. Indices opened mixed today.

Chinese stocks rout persists

Asian stock indices are mixed today while Chinese stocks selloff continues despite talk of possible lowering of banks’ reserve requirements to boost money supply. Nikkei ended 0.6% higher at 22693.04 as yen slide against the dollar continued. China’s stocks are falling: the Shanghai Composite Index is 1.4% lower and Hong Kong’s Hang Seng Index is down 1.3%. Australia’s ASX All Ordinaries is up 1% with Australian dollar little changed against the greenback.

Brent lower despite US crude stocks draw

Brent futures prices are extending losses today after reports Iran may support a small rise in OPEC crude output at a meeting tomorrow in Vienna. The US Energy Information Administration reported yesterday that domestic crude supplies fell by above expected 5.9 million barrels to 426.53 million. Prices ended lower yesterday: August Brent crude lost 0.5% to $74.74 a barrel on Wednesday