TSMC Q2 profit soars 61% to record high; sees AI demand offsetting forex headwinds

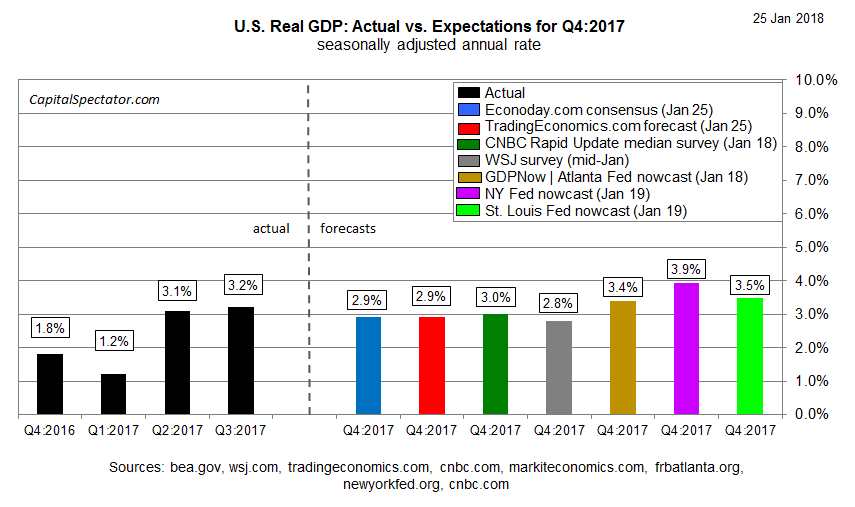

Tomorrow’s preliminary GDP report for the fourth quarter is on track to post a growth rate at or near the roughly 3% pace that’s prevailed in the previous two quarters, according to several estimates. If the projection is accurate, the US economy will log another healthy gain in quarterly output, reaffirming recent evidence that the macro trend picked up speed in 2017.

One of the weaker estimates for Q4 GDP sees growth below 3.0%. The Wall Street Journal’s mid-January survey of economists reflects an average forecast of 2.8% for tomorrow’s official release from the Bureau of Economic Analysis. On the high end of recent estimates is the New York Fed’s latest nowcast (January 19), which anticipates an acceleration in the growth rate in Q4 to 3.9%. The average for the seven estimates in the chart below: 3.2%, which matches Q3’s gain.

Overall, the outlook for a continuation of the firmer rate of economic activity in recent history looks set for a repeat performance in Friday’s Q4 GDP report. Expecting the trend to accelerate further in 2018, however, remains open for debate.

Consider, for instance, yesterday’s survey data for January. PMI readings at the start of 2018 reflect strong manufacturing activity, but the pace of growth is cooler for the services sector – the dominant slice of the US economy. But any slowdown in the expansion in 2018 is expected to be temporary, predicts Chris Williamson, chief business economist at IHS Markit, which publishes the PMIs.

Although the overall pace of economic growth signaled by the surveys waned to an eight-month low, the forward-looking indicators suggest the slowdown will prove transitory. In particular, business optimism about the year ahead improved markedly and inflows of new orders hit a five-month high. Growth should therefore pick up again in coming months.

The IMF’s new economic outlook published this week is also on board with an upbeat view for the year ahead and beyond.

Overall, the policy changes are projected to add to growth through 2020, so that U.S. real GDP is 1.2 percent higher by 2020 than in a projection without the tax policy changes. The U.S. growth forecast has been raised from 2.3 percent to 2.7 percent in 2018, and from 1.9 percent to 2.5 percent in 2019.

“The US economy appears to be on the upswing as 2018 kicks off,” the economics team at Wells Fargo advised last week. “The balance of risks looks to be to the upside.”

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.