The latest Fitch report on US money market funds is showing three key trends:

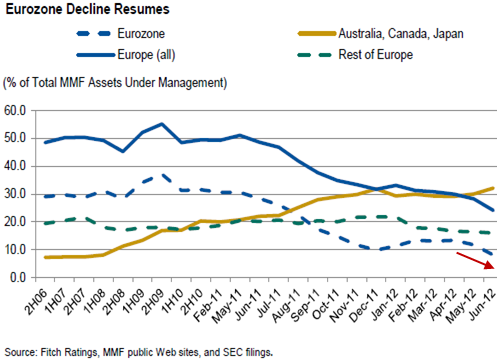

1. On the non-US allocations, exposure to the eurozone continues to decline, replaced by Australia, Canada, and Japan. This is one of the main reasons eurozone banks are exiting US businesses.

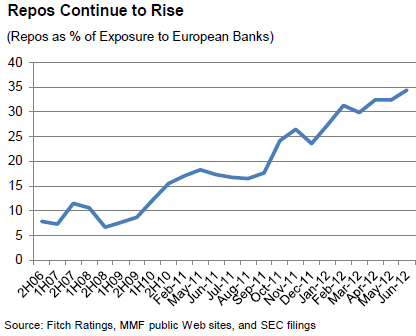

2. Increasingly transactions with European banks are executed via repo (secured loans). We discussed this earlier.

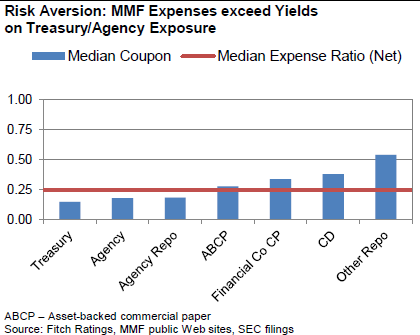

3. This risk aversion is becoming increasingly costly for the fund managers as yields on the "safer" products fall below funds expenses.

The risk aversion is translating into near zero returns even for the "prime" money funds that carry more risk than government funds. As an example the Vanguard Prime Money Market Fund (VMMXX) returns less than 4 basis points per year. Treasury funds are of course even worse. Fidelity US Treasury Money Market Fund (FDLXX) yields 1 basis point a year. (Some Europeans would consider this return to be excellent given their negative rates.) The fund is subsidized by Fidelity because with full fees the return would in fact be negative. Fidelity also closed this fund to small investors by requiring $25,000 minimum. These are difficult times to be in the money market funds business.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.