Bitcoin price today: rises past $120k as US House passes key crypto bills

Tech Earnings Lift US Futures

US futures are pointing to a higher open on Wall Street on the final trading day of the week, buoyed by better than expected earnings reports after the close on Thursday.

We’ve seen a bit of a wobble in US equity markets this week following what was a very steady climb in previous weeks. We’re seeing decent gains across Europe as well, with the exception of Spain and Italy with the former being weighed down by the ongoing independence dispute between Catalonia and Madrid. With votes taking place in Barcelona and Madrid today, it’s likely to be a defining day following an almost month long stand-off between the two.

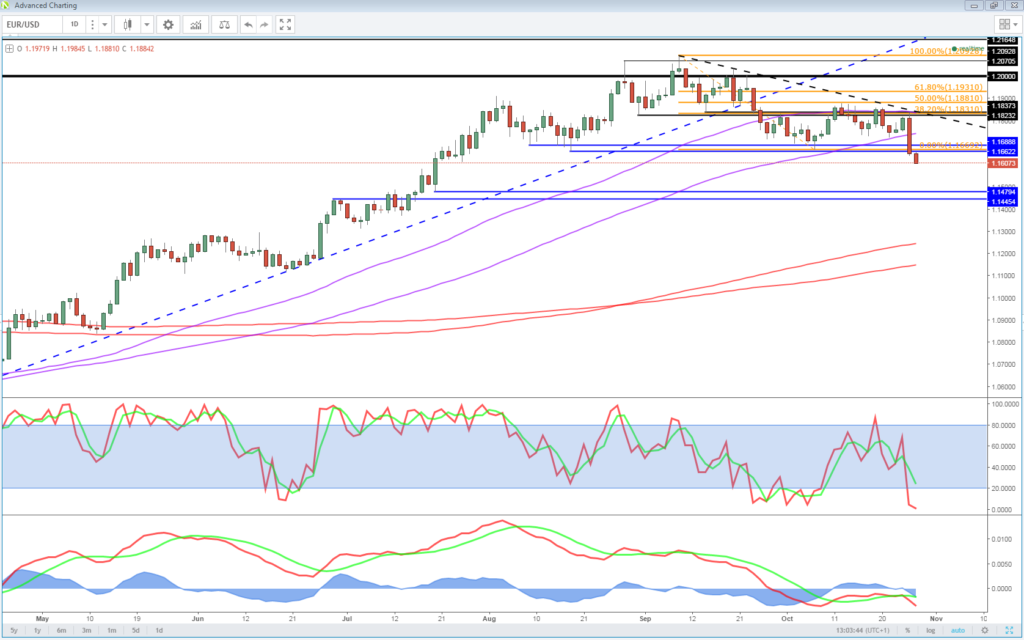

EUR/USD Breaks Technical Support After ECB Decision

The euro is coming under pressure once again on Friday, a move that’s being made worse by the resurgence in the dollar. From a technical perspective, we’ve seen significant breaks in both EUR/USD and the dollar index – not entirely surprising given the significant contribution of the euro to the index – on the back of yesterday’s ECB meeting, which could trigger much bigger gains for the greenback over the coming weeks.

A combination of profit taking as the ECB announcement fell in line with expectations and some very dovish language drove significant losses in the single currency on Thursday and triggered a move below a significant support zone. This in turn forced the dollar index through a major resistance zone which could see it rally over the coming weeks and months. The next big test for EUR/USD could come around 1.15 but further downside is possible.

USD Poised For Strong End to the Year

Should we see the appointment of hawkish policy makers at the top levels of the Federal Reserve in the coming weeks, which is already starting to be priced in, it will only aid the rebound in the greenback. Tax reform is another potential boost for the currency and while Donald Trump has struggled getting parts of his agenda over the line, this may prove a little easier.

It’s been a big week for earnings but focus today will temporarily shift back to the economic data, with fewer companies reporting and GDP figures for the third quarter being released. The economy performed very well in the second quarter and another strong number is expected today, which will only increase the likelihood that the Fed raises interest rates at the December meeting. While there’s no room for maneuver on this for the December meeting – a rate hike is fully priced in – there’s plenty of room next year with markets severely under-pricing the three hikes the Fed has projected for 2018.

Sterling Under Pressure But Remains Range-Bound Ahead of BoE

The pound is also trading in negative territory again on Friday, extending the losses initiated on Thursday that may have been triggered by worrying retail sales data from CBI. Despite this, the pound remains range-bound with traders potentially sitting on the fence ahead of next week’s Bank of England meeting, at which we could see the first rate hike since the financial crisis.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.