What’s wrong with the housing market?

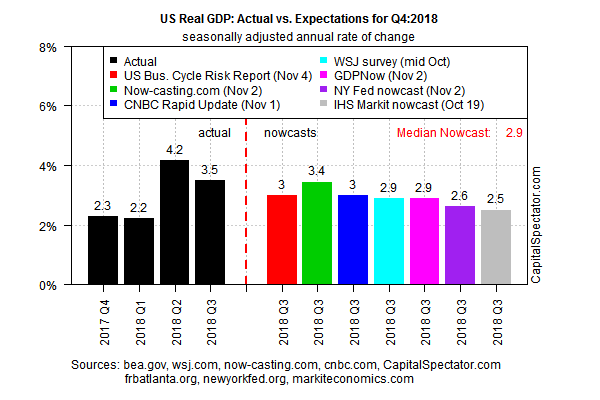

Early estimates of GDP growth for the US in the fourth quarter point to another round of deceleration, based on the median for a set of projections compiled by The Capital Spectator. Although it’s still early in the quarter, leaving room for changes in the outlook based on incoming data, the preliminary numbers hint at the possibility that growth will continue to cool in the final three months of 2018.

The median estimate for Q4 output calls for GDP to rise 2.9% (seasonally adjusted annual rate). If correct, the US growth is on track to dip for a second consecutive quarter, easing to the softest pace since the 2.2% rise in this year’s Q1.

Despite the recent downgrade in GDP estimates, some observers of the economy see a firmer trend unfolding. The chairman and CEO of JPMorgan Chase, Jamie Dimon, told CNN yesterday that “the American economy is still doing quite well. And it may very well be accelerating. Unemployment is going to hit probably a post-war low sometime in the next 12 months.”

A revival in business activity in the services sector in October certainly paints an upbeat profile for the start of Q4, according to last week’s survey data for IHS Markit’s PMI report. “A rebound from a weather-torn September and strong demand propelled service sector growth in October,” said Chris Williamson, chief business economist at the consultancy. “Combined with the steady output growth being recorded in the manufacturing sector, the survey data suggest the economy grew at its fastest rate since July.”

Even so, IHS Markit’s latest estimate for GDP growth in Q4 is just 2.5%, which represents a substantially softer pace compared with Q3’s 3.5% or Q4’s strong 4.2%.

Politics will probably be a factor in shaping economic expectations in the weeks ahead. Yesterday’s election verdict appears to be a split government with Democrats taking control of the House while Republicans continue to hold the Senate. As CNBC reports:

With Democrats controlling the lower chamber of a split government, Trump could be forced to soften his aggressive trade strategy with China. The trade war between the two nations has roiled markets and often left investors on edge about the future between the world’s two largest economic powerhouses.

“Our base case of the Democrats taking over the House holds the potential to reduce downside risks from trade policy friction,” Deutsche Bank’s chief equity strategist Binky Chadha wrote last week. “Congressional investigations and potential impeachment proceedings, even though nominal, would likely use up significant bandwidth while a growing number of Democrats and even Republicans are likely to attempt reducing Presidential power in dealing with trade.”

Perhaps, but for now the numbers suggest that the US economy has peaked. Growth will likely prevail for the near term, but the best guesstimate at the moment calls for another round of deceleration in economic activity as 2018 heads into the final stretch.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.