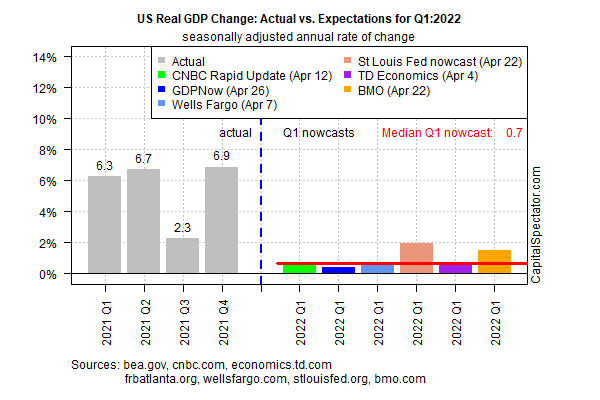

Tomorrow’s initial first-quarter estimate of US GDP from the government (scheduled for Thurs., Apr. 28) is expected to reveal a sharp deceleration in growth, based on a set of nowcasts compiled by CapitalSpectator.com.

The median Q1 estimate is a weak 0.7% rise, a fraction of the 6.9% surge in the previous quarter, according to the Bureau of Economic Analysis. Today’s revised Q1 nowcast is roughly in line with the previous estimate published on Apr. 12.

If Q1 GDP’s momentum posts a dramatically softer gain, the news will strengthen the bearish macro narratives that have taken flight lately. That includes a new forecast this week from Deutsche Bank economists, who now predict a deep recession is brewing.

“We assume conservatively that a Fed funds rate moving well into the 5% to 6% range will be sufficient to do the job [of tipping the economy into recession] this time,” the authors advise in a research note from Tuesday. “This is partly because the monetary-tightening process will be bolstered by Fed balance-sheet reduction, which our US economics team estimates will be equivalent to a couple additional 25 basis-point rate hikes.”

Nikolai Roussanov, an economist at Wharton School, University of Pennsylvania, says “the US economy is quite strong at the moment, but there is indeed some risk of slipping into a recession.”

Nonetheless, published data to date still reflect low recession risk. Several business cycle indicators published to date point to a solid pace of expansion.

The assumption by some, perhaps most analysts, is that the various shocks now reverberating through the global economy—including higher commodity prices, elevated inflation, rising interest rates and blowback from the Ukraine war—will create harsh headwinds in the months ahead.

For the immediate future, however, the upcoming data isn’t expected to show a conspicuously stumbling economy. Notably, this Friday’s March numbers on consumer spending are projected to report a strong acceleration in growth to 0.6% over February, based on Econoday.com’s consensus point forecast.

Meanwhile, tomorrow’s weekly update on jobless claims—a leading indicator for the labor market—is on track to report that new filings for unemployment benefits remain close to a 50-year low.

The next major update of US economic news beyond this week is the April data for US payrolls (Fri., May 6). But here, too, economists are looking for another solid gain in hiring.

None of this means that recession risk is low going forward, but it does suggest that the start of an NBER-defined contraction isn’t imminent.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI