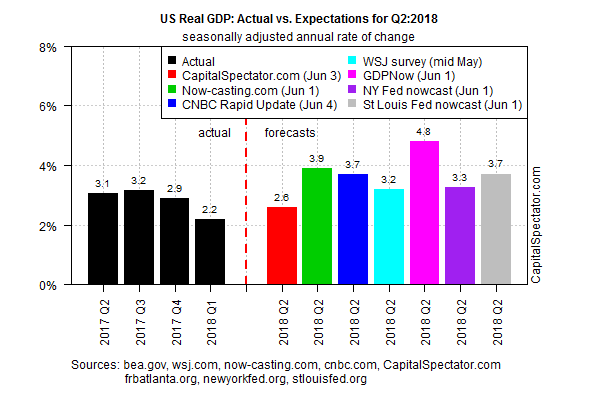

Recent estimates for US economic output in the second quarter continue to anticipate a robust acceleration after the subdued rise in Q1, based on the median of several forecasts compiled by The Capital Spectator. The current projections see real GDP growth in Q2 picking up to 3.7% (seasonally adjusted annual rate) from Q1’s 2.2%. The Bureau of Economic Analysis is scheduled to publish its initial GDP report for the second-quarter on July 27.

The strongest Q2 estimate in the group is the Atlanta Fed’s GDPNow model, which expects a sizzling 4.8% gain in Q2, as of the June 1 update. At the low end of the scale is CapitalSpectator.com’s 2.6% projection, which is based on a simple linear regression of the so called Big-4 economic indicators: payrolls, industrial production, real personal consumption expenditures, and real personal income excluding current transfer receipts.

The upbeat estimates for the current quarter coincide with a new warning from leading business economists that the tax cuts passed late last year raise the probability that a US recession may strike by 2020. The National Association for Business Economics (NABE) on Monday advised that a new quarterly survey of panelists shows that two-thirds of its members think a new downturn could start in less than two years.

Perhaps, but the macro trend at the moment is quite strong and the probability that a new NBER-defined recession has started remains virtually nil, based on last month’s economic profile.

Recent survey data published by IHS Markit also reflects a healthy estimate of current US economic conditions. “The flash May PMI surveys point to an encouragingly solid pace of economic growth of 2.5-3% with monthly job gains running at just over 200,000,” said Chris Williamson, IHS Markit’s chief business economist, on May 23.

Last week’s surprisingly strong employment report for May supports Williamson’s analysis. The private sector added 218,000 workers last month, which lifted the year-over-year rate to a healthy 1.9% advance – a 16-month high.

Meanwhile, investor sentiment remains positive on the economic outlook. “Investors are looking at the broader data from the US and saying, ‘We’re still doing okay,’ – especially compared to the rest of the world,” says Paul Nolte, portfolio manager with Kingsview Asset Management. “The market isn’t concerned with politics in the long-term. It’s focusing more on earnings and the economy.”

In the short run, however, there’s a debate about the potential blowback from the trade tariffs that President Donald Trump is pushing. Even the president’s economic adviser admits that the tariffs could be a problem for growth at some point. As Business Insider reports:

Larry Kudlow, the president’s top economic adviser, told host Chris Wallace on “Fox News Sunday” that the tariffs could undermine the economy’s steady growth.

During the interview, Wallace highlighted the strength of Friday’s jobs report and asked if Trump’s tariffs on steel, aluminum, and Chinese goods could “jeopardize” the progress of the labor market and economy.

“Oh, it might, I don’t deny that,” Kudlow said. “You have to keep an eye on it.”

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI