Talking Points:

- US DollarMay See Deeper Losses as Soft ISM Data Weighs on Fed Outlook

- British PoundMay Stabilize as PMI Figures Arrest Slide in BOE Expectations

- See Economic Releases Directly on Your Charts with the DailyFX News App

The US Dollar broadly declined in overnight trade, falling as much as 0.4 percent on average against its leading counterparts. The move appeared to reflect continued response to dovish comments from San Francisco Fed President John Williams, who will rotate into a voting position on the rate-setting FOMC committee this year. Williams said there is “no reason whatsoever to rush tightening”, adding the economy still needs policy accommodation and hinting the first post-QE rate hike may appear late in 2015.

Policy-sensitive currencies at both ends of the rate spectrum outperformed, with the Yen as well as the Australian and New Zealand Dollars leading the way against the greenback. The Japanese unit appeared to find additional support from risk appetite trends as Asian shares followed Wall Street lower, spurring liquidation of carry trades funded via the perennial low-yielder. The MSCI Asia Pacific regional benchmark equity index slid 1.7 percent.

More of the same may be ahead as the spotlight turns to the US Non-Manufacturing ISM figure. Service-sector growth is expected to have slowed in December having hit a three-month high in November. US economic news-flow has deteriorated relative to consensus forecasts recently, opening the door for a downside surprise. Such an outcome may further cool Fed rate hike bets, adding to downward pressure on the buck.

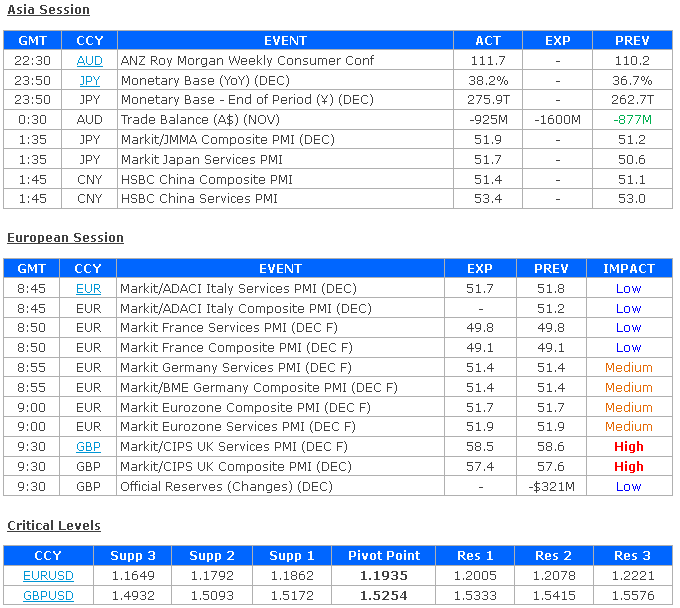

December’s UK PMI figures headline the calendar in European hours. The Composite index is due to show the pace of manufacturing and services sector growth narrowly slowed last month. A string of upbeat data outcomes over the past three weeks suggests analysts may have underestimated the economy’s vigor, hinting an upside surprise could be in the cards. An upbeat print may help arrest the slide in BOE rate hike bets and stabilize the British Pound after the currency tumbled to a 17-month low.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI