The single currency has added to the dollar on Thursday morning. EUR/USD is trading near 1.1380 attempting to gain above the support at the 1.13 level it reached yesterday.

Bearish: The weak data of the wholesale prices in Germany are also stocking up against the Euro at 0.0% with the expected +0.5%, alongside the four months of the eurozone’s foreign trade surplus decline.

Bullish: the Euro got support on the back of the announcement of trade talks between China and the U.S.

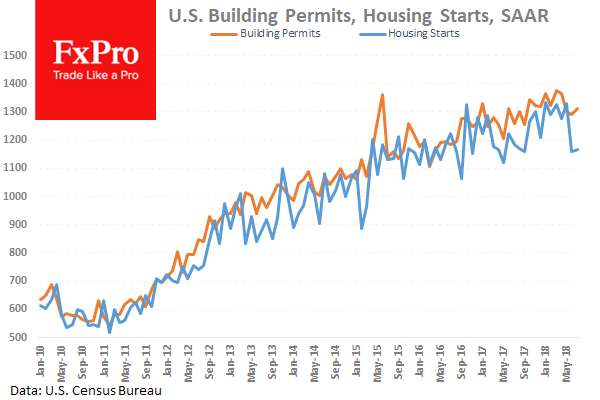

The US building activity is worryingly on the back foot at the moment. The data published some minutes ago saw growth of the Housing Starts for July by just 0.9% against the expected 7.4%, all after seeing a big dip by 12.9% in the month before. The building activity is a useful indicator of the housing market and often reflects the consumers’ confidence in economic expectations. Sudden weak data put some pressure on the Dollar, allowing EUR/USD to continue its second day recovery, after initially having been sent to 1.1390 after the report’s publication.

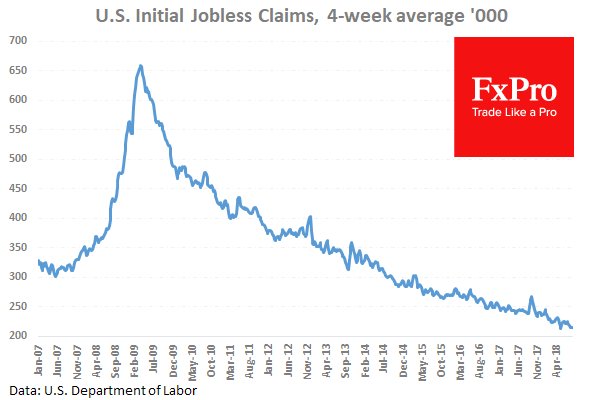

Among other news: Weekly initial claims were slightly better than expected. But many market observers have grown accustomed to the indicators that ply around at their lowest in the last 40 years. This fact is ignored by the markets as long as there are too few signs that the tight labor market causes the increase of the inflationary pressure. So far, inflation is effected much more by the dynamics of the energy prices and the dollar rate.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.