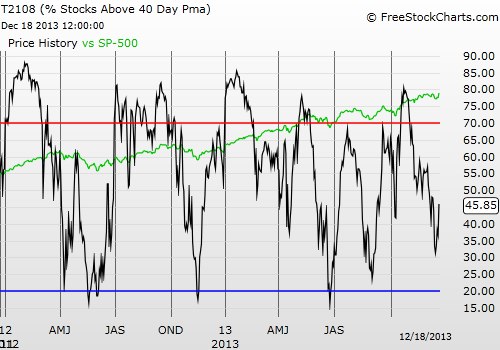

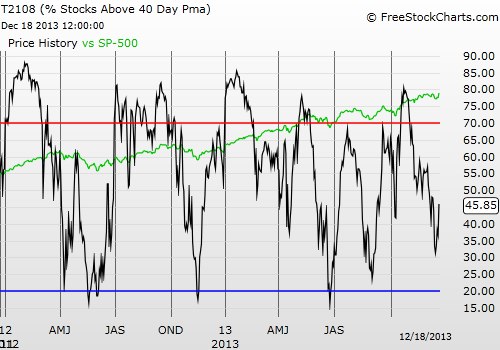

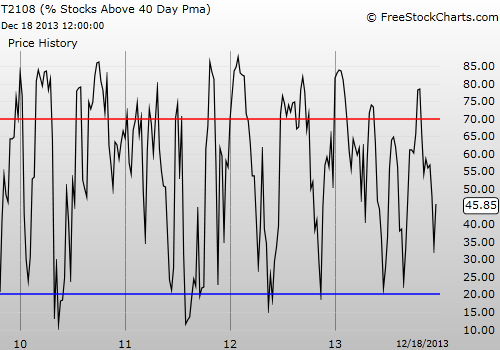

T2108 Status: 45.9% (20.4% increase)

VIX Status: 13.8 (14.9% drop)

General (Short-term) Trading Call: Aggressive traders experiencing whiplash. Need to hold now and look for confirmation…OR continue taking small bets until market follows through in a given direction. More below.

Active T2108 periods: Day #116 over 20% (overperiod), Day #12 under 50%, Day #29 under 60%, Day #34 under 70%

Commentary

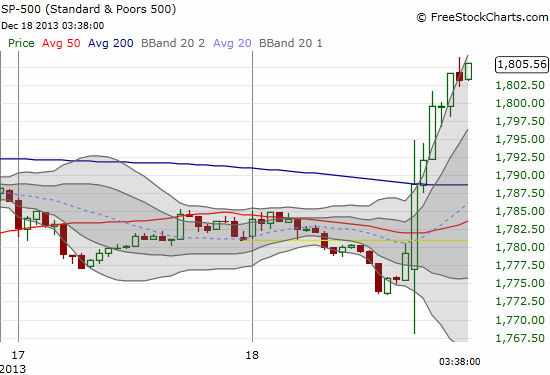

The S&P 500 (SPY) is above 1800 yet again in dramatic fashion. The index closed the day at a marginal new all-time high with a 1.7% gain. All the gains came after the Federal Reserve announced a tease of a taper by shaving a little “edge” off its bond buying program and promising to keep rates low for what now almost seems like an eternity. It reads like a sample-sized tapering: just enough to signal to the markets a change in direction, but not enough to have any real impact on anything. The market was a bit indecisive in the wake of the announcement as the index first dipped to its 50DMA before shooting upward like a rocket.

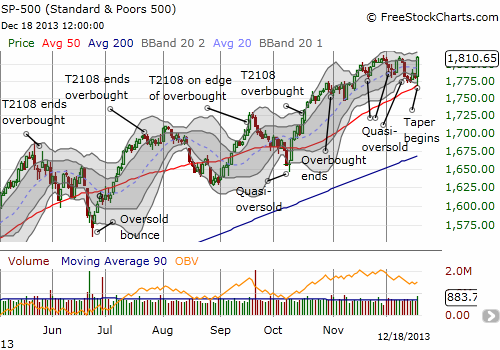

This looks like upside resolution all over again. The bias flips right back to the upside especially with T2108 putting on a strong showing from what were another set of quasi-oversold conditions. Note that the T2108 Trading Model (TTM) accurately anticipated another day of selling after the quasi-oversold conditions were met. However, looking back, we find ourselves with yet another resounding example of the power of quasi-oversold conditions in an uptrend: an eventual recovery, often sharp, from the previous selling. At this point, I am not even sure what it will take for this market to drop to TRUE oversold conditions (T2108 at or below 20%)! T2108 was last oversold in June – 116 trading days ago (the 20% overperiod).

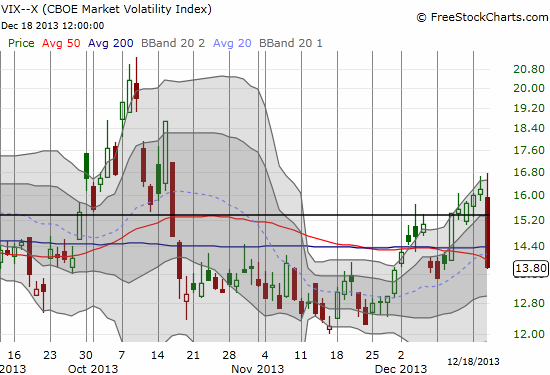

While I was VERY surprised by the strength of the market post-Fed, I was not surprised by the collapse in volatility in the wake of the Fed. As I mentioned in the last T2108 Update, I bought puts on ProShares Ultra VIX Short-Term Futures ETF (UVXY) in anticipation of an implosion in volatility leading into or in the immediate wake of the Fed announcement. Given the strong move in the S&P 500, I decided to hold the puts instead of selling them immediately as I originally planned. Assuming the market follows through in the coming week or two, volatility will go even lower from here and UVXY will suffer mightily. The VIX plunged 14.9%, and UVXY fell by a similar amount.

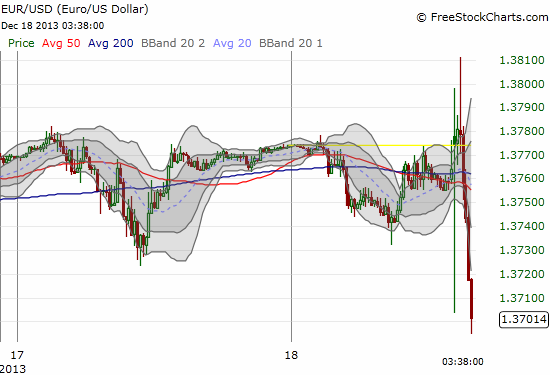

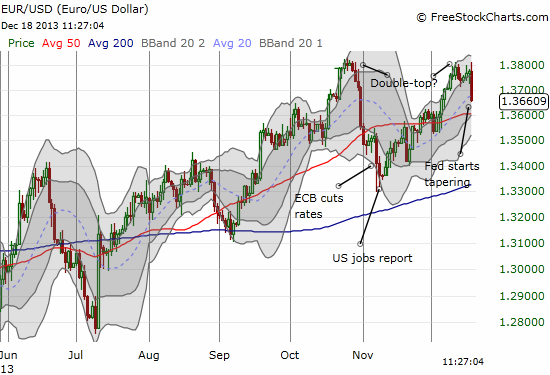

The impact in foreign exchange was equally dramatic on an intraday basis. The fireworks were enhanced by a very strong employment report from the United Kingdom overnight. I will have to dedicate an entire post to the intriguing forex implications of this post-taper era. I will just say for now that I have an intense focus on the euro (FXE) right now as I consider it incredibly over-valued. It has been beating up on almost all major currencies in recent weeks and even months. In particular, its out-performance against the U.S. dollar and the British pound is long overdue for a major rollback. Note that the euro is still above its level after the ECB CUT rates in early November…

EUR/USD" border="0" height="375" width="550">

EUR/USD" border="0" height="375" width="550">

While the euro reacted as I thought it should after taper starts, it is still well above where it was when ECB cut rates. EUR/USD may have printed a firm double top however….

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Full disclosure: Long SSO puts and calls, long UVXY puts, long VXX shares, net short euro, net long pound, net long U.S. dollar

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI