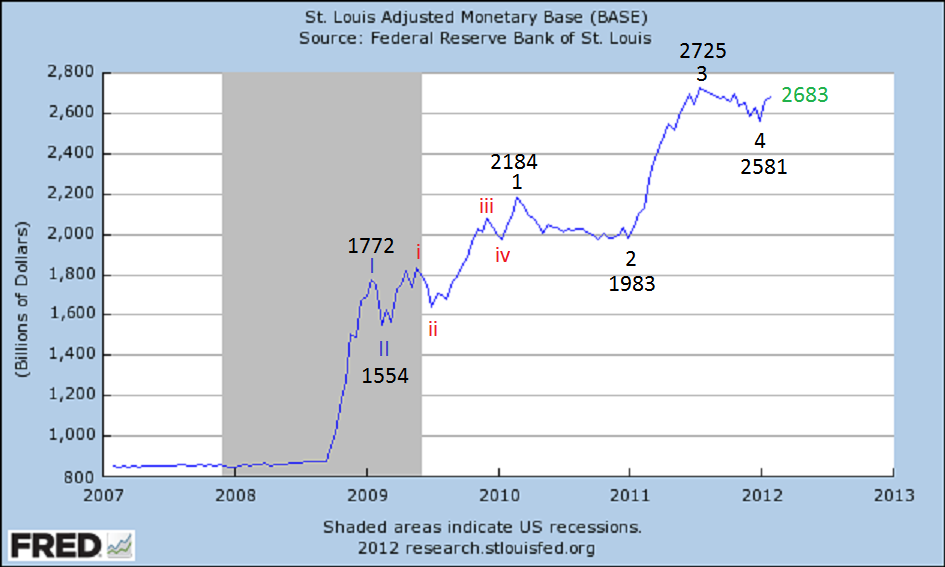

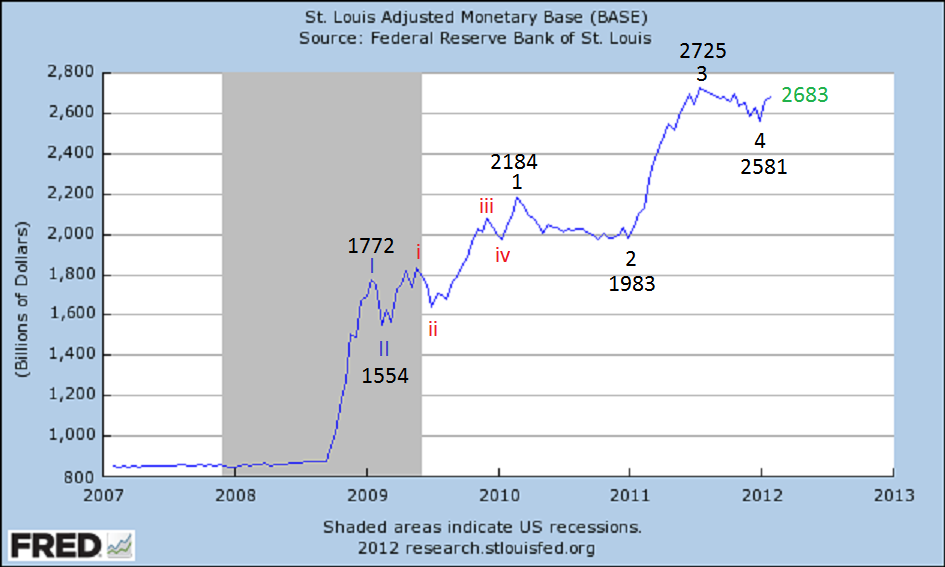

Since late 2008 the Fed’s monetary base has been increasing exponentially. In fact, many of the world’s central banks have been on the same path: fighting the deflationary secular cycle with a reflationary monetary policy. The ECB’s monetary base recently exceeded, with LTRO 2, even that of the Fed.

For the past few years we have been tracking this reflationary cycle in OEW terms. We are expecting five Primary waves up to complete, from the 2008 lows, before this cycle ends. Thus far we have counted Primary waves I and II, at $1.772 tln and $1.554 tln respectively, in 2009. Then Primary wave III started to subdivide, as they often do, into five Major waves. Notice the detail in Major wave 1 into its $2.184 tln high in 2010. QE 1 ended a few months later. Then Major wave 2 bottomed at $1.983 tln in early 2011, as QE 2 started to kick in. Just after QE 2 concluded Major wave 3 topped at $2.725 tln. Then it late 2011 Major wave 4 bottomed at $2.581 tln.

It now appears Major wave 5 is underway as the base has risen to the $2.683 tln level. During this cycle a $100 bln increase, from a low, has indicated a new uptrend is underway. The Fed’s Operation Twist, due to end in June 2012, may be doing more than just extending $400 bln of their holdings from short term USG paper to long term MBS paper. Since these uptrends usually last for several months we’re now expecting the monetary base to hit around $3.0 tln in 2012. Primary wave III is likely to conclude at that time. Then the monetary base should decline about $200-$300 bln before Primary wave V, and possibly QE 3, begins.

For the past few years we have been tracking this reflationary cycle in OEW terms. We are expecting five Primary waves up to complete, from the 2008 lows, before this cycle ends. Thus far we have counted Primary waves I and II, at $1.772 tln and $1.554 tln respectively, in 2009. Then Primary wave III started to subdivide, as they often do, into five Major waves. Notice the detail in Major wave 1 into its $2.184 tln high in 2010. QE 1 ended a few months later. Then Major wave 2 bottomed at $1.983 tln in early 2011, as QE 2 started to kick in. Just after QE 2 concluded Major wave 3 topped at $2.725 tln. Then it late 2011 Major wave 4 bottomed at $2.581 tln.

It now appears Major wave 5 is underway as the base has risen to the $2.683 tln level. During this cycle a $100 bln increase, from a low, has indicated a new uptrend is underway. The Fed’s Operation Twist, due to end in June 2012, may be doing more than just extending $400 bln of their holdings from short term USG paper to long term MBS paper. Since these uptrends usually last for several months we’re now expecting the monetary base to hit around $3.0 tln in 2012. Primary wave III is likely to conclude at that time. Then the monetary base should decline about $200-$300 bln before Primary wave V, and possibly QE 3, begins.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI