Bitcoin price today: muted at $118k but altcoins soar as House passes new bills

While a trading update might have been anticipated the departure of the CEO is a major surprise. The return of the Chairman to the CEO role as an interim measure provides an element of reassurance and continuity, as does the commitment to an increased final dividend despite a cut of 9% to FY17 EPS. The UK declines are concerning, however it is not the largest regional contributor. We believe the larger US and export market contributions and recent order intake should provide a solid foundation for future growth, with the invest and grow strategy to remain in focus.

MOD budget issues lead to estimates reduction

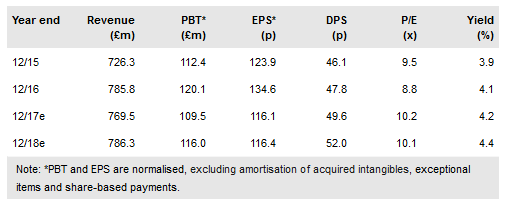

Ultra Electronics Holdings Plc (LON:ULE) identifies two issues that impact H217 underlying profitability. The first is the deferral and cancellation of programmes by the MOD which, while diminishing part of group sales, has left FY17 revenues expectations at £770m or 5% below our previous assumptions. We assume the domestic defence budget constraints will persist next year and beyond due to the FX-induced affordability issues in the UK. To a degree, this offsets improving prospects for growth elsewhere, notably in the US, although a forecast 5% adverse FX movement is also unhelpful. In addition, Herley in the Communications & Security division requires increased investment in FY17 to support the additional SEWIP programme modules that it has won over and above the acquisition’s business case. In combination management expects operating profit at c £120m for FY17 compared to our £131.5m previous forecast.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.