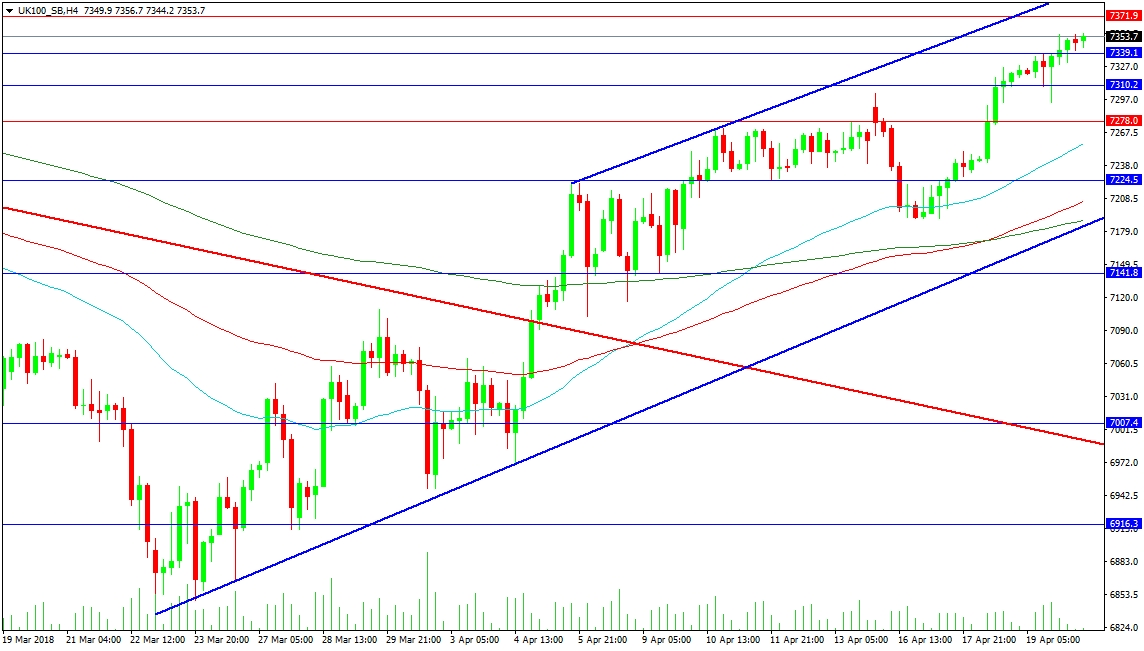

The UK100 Index is surging higher, as a risk-on tone dominated markets earlier this week. The upward pressure has been maintained in this index due to weakness in the GBP, exasperated by BOE Governor Carney yesterday and sluggish economic data. The market has climbed above resistance at 7340.00, signalling a need to reach the 7390/7400 area. This is a strong previous point of control zone. On the way up to that area, the 7371.9 level forms medium-term resistance.

Support on the chart comes in at 7310.00, followed by 7278.00. The 50-period MA is all the way down at 7258.00, with the 100-period at 7205.8. The 200-period MA is supporting the rising supporting trend line at 7190.00. A loss of this area suggests a retest of 7141.80, followed by 7060.00 and the 7000.00 round number.

The GBP/CHF pair has pulled back on worrying UK economic data over the past couple of days. The high was set at 1.38550 and the 1.37500 support level was broken on the retracement. The rising supporting trend line at 1.36835 was broken and retested, with price currently trading at 1.36531. These levels have now become resistance. The slowing of rate hikes in the UK could see this market fall further.

Support is now seen at 1.36000, followed by 1.35546 and 1.34644, which would mean a slip back into the old trading range. The 50 DMA is at 1.33988, with the 1.33611 level of support below. The 1.32250 area has operated as a point of control, with the 1.31460 level being used very clearly as both support and resistance over the last six months. The 200 DMA at 1.31036 and the 1.30835 level mark out the region of the recent break out higher for the leg up.

By Edward Anderson, FxPro Analyst