The holding pattern that the currency markets have been operating in over the past few days continued Thursday as investors saw both strength and weakness in the global economy with bears and bulls calling the day a draw come the close.

Following the unexpected trip lower in the unemployment rate last Friday to the lowest level during the Obama administration, yesterday’s Initial Jobless Claims was expected to bring some semblance of normality back to the employment landscape. What we got, however, was the lowest level of jobless claims since 2008 and confusion as to whether all the states had been counted. New claims fell by 30,000 to 339,000, which is a huge deviation from normal variance and shows that something is likely to be wrong with the figures from a large state, suspected to be California. We’ll find out next week.

Uncertainty Lingers

That said, recent data does suggest that the employment market in the U.S. is showing more than just green shoots of recovery so far. Firings are slightly lower, but businesses will remain reticent to increase hiring until uncertainty over the global crisis starts to subside.

The large beat in the unemployment number propelled equities back into the green for the day breaking a run of losses since the week began. EUR/USD and GBP/USD both fought back above 1.29 and 1.60 respectively as well but will need further good news to extend higher you feel.

The Euro also moved well on the details of an Italian auction of 3yr money. The yield on the debt was slightly higher than last time round, coming in at 2.86% vs 2.75%, but the demand was also higher with a bid-to-cover of 1.67 vs 1.49 at the auction in September. The fear had been that the increase in negativity surrounding the Spanish economy would see some fear spread to Italian funding markets although that seems to be misplaced for the moment certainly. Our belief is that the risk exists and increases with the delay to a Spanish aid program. Combine that with a slip in Italian economic data and you’ll start to see more and more stories about Italy.

The USD/JPY was also one of the big movers on the day following initially speculation and then confirmation that Softbank, the Japanese communications company, was in talks to buy Sprint Nextel, a US cell phone carrier. Reports put the figure at around $20bn which is, whichever way you dice it, a lot of money. USDJPY was about 35bps higher on the session with all XJPY higher.

Asia

Comments out of the IMF/G7 meetings in Japan have been relatively on message, with Christine Lagarde verbalising the recommendations of the IMF’s World Economic Outlook released earlier this week. Everyone now seems to agree that the IMF is explicitly calling on governments to relax austerity conditions in order to get growth going again. The German Finance Minister Wolfgang Schaeuble clashed with her on this, taking a very George Osborne-esque line of “When you want to climb a big mountain and you start climbing down the mountain, then the mountain will get even higher.” Market reaction has been quiet so far.

Headlines from the Tokyo meeting will continue through the morning while we are waiting for the consumer confidence numbers from the US at 14.55. An uptick in housing combined with a couple of good jobs reports and an increase in consumer confidence would certainly get the world thinking a US recovery is very much on the cards.

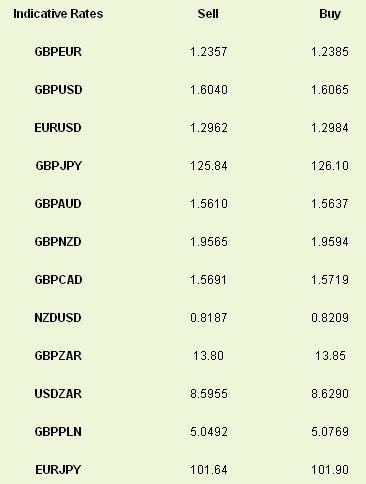

Latest exchange rates at time of writing

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.