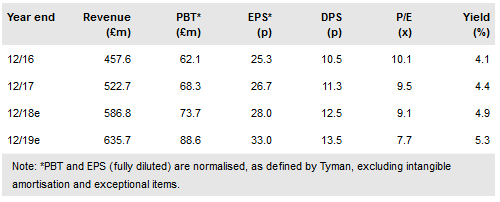

Tyman Plc (LON:TYMN) trading update referenced firmer demand in two important European markets, some short-term input cost drag in North America and two small acquisitions, which enhance the group’s commercial and residential offerings respectively. Our small net EPS reduction for FY18 is followed by slightly larger upgrades in the following two years and, after a weak share price period, leaves Tyman trading on 7.7x P/E and 6.0x EV/EBITDA multiples in FY19 (first full year of acquisition contributions). Separately, Tyman has announced a CEO succession path with Louis Eperjesi to retire in June 2019, to be replaced by Jo Hallas (from Spectris).

H2 trading update and two acquisitions

Tyman’s 10-month trading update included firmer conditions in the UK, Italy and China in H2 to date and slightly softer US new build start data were noted. Demand conditions elsewhere were similar to those seen in H1 and the company is on course to achieve underlying revenue growth for the year at AmesburyTruth (AT) and SchlegelGiesse (SG) with ERA broadly flat. In addition, acquisitions will benefit all three divisions, especially Ashland Hardware (AT) and Zoo Hardware (ERA), which have continued to perform well. In August, Tyman also bought Profab (ERA, commercial access doors) and Reguitti (SG, Italian residential door hardware manufacturer) for a combined EV of c £19m and annual revenue and EBIT of c £16.5m and £2.5–3m respectively. We have updated our estimates for these transactions, a small favourable £/U$ translation improvement compared to our previously published estimates. These effects are more than offset by a rising input cost pass-through lag in the US of c $5m; pressure here is considered temporary but we have made small reductions to our expected AT margins beyond FY18. The net impact is a c 4% reduction to FY18 earnings and c 2% enhancement in the next two years. Our end FY18 net debt projection is now c £219m, which is at the upper end of the company’s target range of 1.5–2.0x EBITDA (pro forma, annualised acquisition basis).

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI