Are DOGE layoffs set to resume?

1) That the Fed will engage in more QE.

2) That Spain is saved.

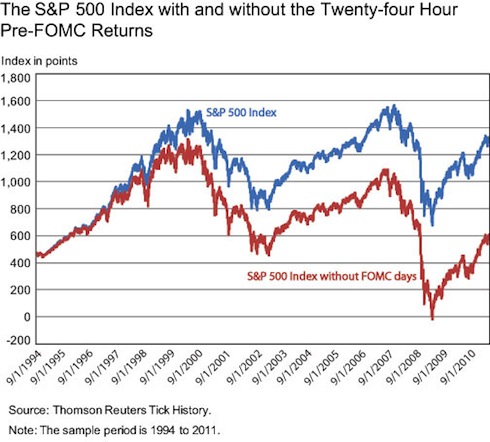

The Federal Reserve has admitted that it targets the stock market. It’s not surprising given that the stock market is the only real “positive” outcome that the Fed can claim resulted from its policies. Whether or not we needed to spend several Trillion Dollars on this is up for debate however, as the Fed itself admits in its research that ALL of the stock market gains over the last three years occurred due to market moves around Fed FOMC days.

Put another way, the Fed could potentially have gotten the same results (S&P 500 at 1,300+) just by staging FOMC meetings in which it announces that it’s ready to act at any time.

This ties in with one of my dominant themes: that the Fed is tapped out and will not engage in aggressive monetary policy unless we have a systemic crisis or a major bank fails. As far back as May 2011, Bernanke was admitting that the consequences of QE were no longer outweighing the benefits. It’s not coincidence that since then the Fed has largely resorted to symbolic interventions (promises to maintain ZIRP) or verbal interventions “we stand ready to act at any time.”

Speaking of systemic risk, details are beginning to surface regarding the Spanish bailout. While everyone views this as a sign that Spain is “saved” I’m curious about the following…

1) If Spain was drawing €300+ from the ECB in May… how does €100 billion solve its problems?

2) If Spain’s prime minister admitted himself that Spain’s capital needs are more in the ballpark of €500 billion… why are people acting as though €100 million solves Spain’s problems?

3) Where will the money come from? The EFSF is essentially tapped out and SPAIN contributes 12% of the ESM’s funding (combined with Italy you’re looking at 30% of the ESM’s funding)… so Spain is essentially bailing itself out?

The reality is that Spain needs much more money and it needs it fast. The idea that handing the country a couple tens of billions of Euros every few months will cover its capital needs is absurd.

Indeed, the far more important question to be asked is: WHY weren’t the EFSF or ESM made larger during the recent EU leader meeting?

The answer? Europe, specifically Germany, is tapped out.

First off, the country is only €328 billion away from reaching an official Debt to GDP of 90%: the level at which national solvency is called into question.

Moreover, that €328 billion has already been spent via various EU props. Indeed, when we account for all the backdoor schemes Germany has engaged in to prop up the EU, Germany’s REAL Debt to GDP is closer to 300%.

In Euro terms, Germany now has €1 trillion in exposure to the EU via its various bailout mechanisms. That’s EQUAL TO roughly 30% of German GDP.

If even a significant portion of that €1 trillion goes bad (which it will as this money has been spent helping the PIIGS), Germany’s financial system will take a MASSIVE hit.

This will guarantee Germany losing its AAA status, which in turn makes its funding costs much higher (see what happened to France in the last year: that country is now facing bank runs and its own solvency Crisis which you’ll be hearing about in the coming weeks).

Angela Merkel is up for re-election next year. There is no way on earth she’ll opt to let Germany get dragged down by the EU. She’s even said she will not allow Eurobonds for “as long as [she] lives.”

So… is Spain really saved? Or is this just another “hope and pray” move from EU leaders who realize that the money tap has run dry (the ECB hasn’t bought an EU sovereign bond in nearly four months).

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.