Trump has once again backed semiannual reporting. What could this mean for stocks?

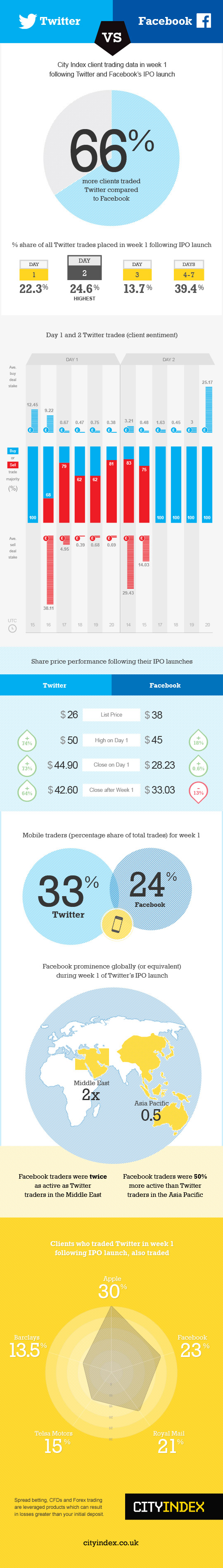

Twitter Inc, (TWTR) made its much publicised initial public offering on November 7, 2013, almost eighteen months after rival social networking giant Facebook Inc, (FB) launched its IPO in May 2012. Twitter’s IPO attracted a huge amount of public and market attention, with shares expected to open much higher than the firm’s listed opening price of $26 (which would give it a minimum market valuation of $13.6bn).

Expectations were high and traders weren’t disappointed, with the company closing the first day of trading 73% higher at $44.9 – a far cry from Facebook’s performance on the first day of launch.

But how has Twitter performed when compared to Facebook since its first day of trading? More crucially, how did the two companies stack up in performance during their crucial first week of trading? How have City Index clients traded both Twitter and Facebook during their first week as public companies. Were City Index clients more bullish with Twitter than Facebook?

See the infographic below for information on how Twitter’s IPO stacked up against Facebooks’ in the first crucial week of trading as a listed company.

Disclosure: FX Solutions assumes no responsibility for errors, inaccuracies or omissions in these materials. FX Solutions does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FX Solutions shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials.

The products offered by FX Solutions are leveraged products which carry a high level of risk to your capital with the possibility of losing more than your initial investment and may not be suitable for all investors. Ensure you fully understand the risks involved and seek independent advice if necessary.

Which stocks should you consider in your very next trade?

The best opportunities often hide in plain sight—buried among thousands of stocks you'd never have time to research individually.

That's why smart investors use our Stock Screener with 50+ predefined screens and 160+ customizable filters to surface hidden gems instantly.

For example, the Piotroski's Picks method averages 23% annual returns by focusing on financial strength, and you can get it as a standalone screen. Momentum Masters catches stocks gaining serious traction, while Blue-Chip Bargains finds undervalued giants.

With screens for dividends, growth, value, and more, you'll discover opportunities others miss. Our current favorite screen is Under $10/share, which is great for discovering stocks trading under $10 with recent price momentum showing some very impressive returns!