Bitcoin price today: rises to $111.5k, altcoins lag ahead of payrolls test

The Hoot

Actionable ideas for the busy trader delivered daily right up front

Well I did say that Monday was a tough one. And both the SPX and the Nasdaq did finish lower, apparently courtesy of some comments by Carl "Captain Obvious" Icahn to the effect that stocks could experience a "big drop". But the Dow managed to hang in there and finish in the green, so that's a miss for me, though not by much. Let's see how this latest wrinkle translates to Tuesday as we wend our way through November.

The technicals (daily)

The Dow: On Monday the Dow closed on its upper BB again with another new record despite Uncle Carl's attempt to rain on the parade. But the result was a spindly spinning top. And with the indicators now well into overbought, this one has to be taken a bit more seriously. But without RTC or stochastic confirmation, I'm still not calling a top here.

The VIX: The VIX confirmed Friday's spinning top by bouncing strongly off its lower BB on Monday in a move big enough to clear its descending RTC for a bullish setup. We also got a bullish stochastic crossover so I'm saying the VIX is going higher on Tuesday.

Market index futures: Tonight all three futures are higher at 12:33 AM EST with ES up by 0.10%. On Monday ES gave us a bearish almost-dark cloud cover and a bearish stochastic crossover. But we remain in the rising RTC and the overnight is showing some resilience. We've seen a number of these one-day fake-out breakdowns over the past two months, so I'm reluctant to call a reversal here just yet without some confirmation.

ES daily pivot: Tonight the pivot dips from 1792.00 to 1791.08. After dropping below at 3 PM Monday, ES has been slowly drifting higher and in fact just mounted an attack on the new pivot. It failed, but it seems likely we'll see at least one more before too long. So while this indicator is now bearish, the pivot is very much in play here.

Dollar index: Last night I wrote "it looks like there's still lower to come" and so it did with the dollar gapping down to finish with a stubby green hammer and a 0.09% loss. But we have no other confirmation from the RTC or the indicators, so the jury remains out on whether this signals a move higher Tuesday.

Euro: Last night I wrote "there's no resistance til 1.3519, so I expect the euro to take a look at that level on Monday."

Transportation: Last night I wrote "Monday could be a topping day" and the trans indeed produced a fat red spinning top that topped out at 7245 before retreating to form a dark cloud cover. It also gave us a bearish RTC setup and a bearish stochastic crossover. So this chart is looking lower for Tuesday.

Hmm. Tonight we seem to have more spinning tops than FAO Schwartz. And we've got futures that are refusing to roll over. But we also have a VIX wanting to move higher so I'm going to make a conditional call: if ES can break back above its pivot in convincing fashion by mid-morning Tuesday, we'll close higher, else lower.

ES Fantasy Trader

Portfolio stats: the account remains at $110,625 after 17 trades (13 for 17 total, 7 for7 longs, 6 for 10 short) starting from $100,000 on 1/1/13. Tonight we stand aside.again.

Actionable ideas for the busy trader delivered daily right up front

- Tuesday higher only if ES pivot passed by mid-morning, else lower.

- ES pivot 1791.08. Holding below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside

Well I did say that Monday was a tough one. And both the SPX and the Nasdaq did finish lower, apparently courtesy of some comments by Carl "Captain Obvious" Icahn to the effect that stocks could experience a "big drop". But the Dow managed to hang in there and finish in the green, so that's a miss for me, though not by much. Let's see how this latest wrinkle translates to Tuesday as we wend our way through November.

The technicals (daily)

The Dow: On Monday the Dow closed on its upper BB again with another new record despite Uncle Carl's attempt to rain on the parade. But the result was a spindly spinning top. And with the indicators now well into overbought, this one has to be taken a bit more seriously. But without RTC or stochastic confirmation, I'm still not calling a top here.

The VIX: The VIX confirmed Friday's spinning top by bouncing strongly off its lower BB on Monday in a move big enough to clear its descending RTC for a bullish setup. We also got a bullish stochastic crossover so I'm saying the VIX is going higher on Tuesday.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Market index futures: Tonight all three futures are higher at 12:33 AM EST with ES up by 0.10%. On Monday ES gave us a bearish almost-dark cloud cover and a bearish stochastic crossover. But we remain in the rising RTC and the overnight is showing some resilience. We've seen a number of these one-day fake-out breakdowns over the past two months, so I'm reluctant to call a reversal here just yet without some confirmation.

ES daily pivot: Tonight the pivot dips from 1792.00 to 1791.08. After dropping below at 3 PM Monday, ES has been slowly drifting higher and in fact just mounted an attack on the new pivot. It failed, but it seems likely we'll see at least one more before too long. So while this indicator is now bearish, the pivot is very much in play here.

Dollar index: Last night I wrote "it looks like there's still lower to come" and so it did with the dollar gapping down to finish with a stubby green hammer and a 0.09% loss. But we have no other confirmation from the RTC or the indicators, so the jury remains out on whether this signals a move higher Tuesday.

Euro: Last night I wrote "there's no resistance til 1.3519, so I expect the euro to take a look at that level on Monday."

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

and that's just what it did, hitting an intraday high of 1.3543 before finishing at 1.3500 with a spindly spinning top. However, the new overnight isn't confirming that, rising instead as the euro seems obsessed with that 1.3519 level. So although RSI is extremely overbought now, we remain in a rising RTC and have no bearish stochastic crossover yet. Therefore, it is too soon to call this one lower. Transportation: Last night I wrote "Monday could be a topping day" and the trans indeed produced a fat red spinning top that topped out at 7245 before retreating to form a dark cloud cover. It also gave us a bearish RTC setup and a bearish stochastic crossover. So this chart is looking lower for Tuesday.

Hmm. Tonight we seem to have more spinning tops than FAO Schwartz. And we've got futures that are refusing to roll over. But we also have a VIX wanting to move higher so I'm going to make a conditional call: if ES can break back above its pivot in convincing fashion by mid-morning Tuesday, we'll close higher, else lower.

ES Fantasy Trader

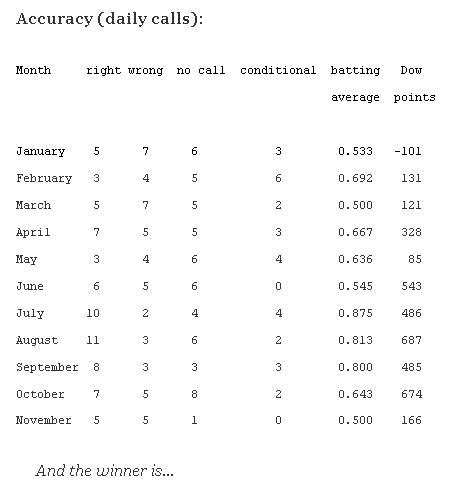

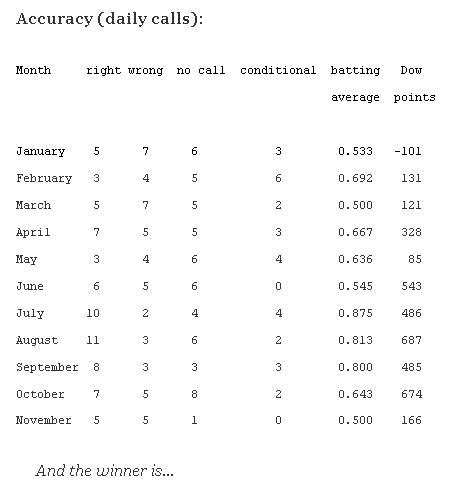

Portfolio stats: the account remains at $110,625 after 17 trades (13 for 17 total, 7 for7 longs, 6 for 10 short) starting from $100,000 on 1/1/13. Tonight we stand aside.again.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 3 out of 4 global portfolios are beating their benchmark indexes, with 98% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?