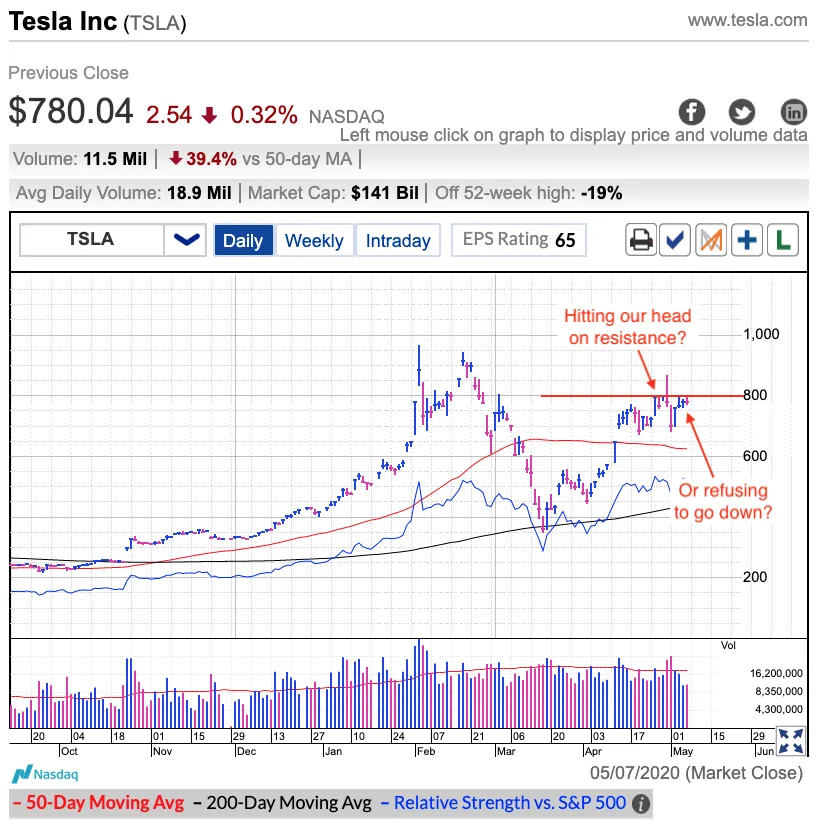

Tesla (NASDAQ:TSLA) has been struggling with $800 resistance the last two weeks. The most promising day occurred last week when the stock smashed through resistance following a strong earnings report. Yet more ominous, it tumbled 10% from those early highs and finished the day solidly in the red.

I won’t bother with a fundamental analysis of Tesla . Number one, there are plenty of other articles written about how under or overvalued TSLA is (take your pick). But more importantly, number two, I don’t care. I trade the stock, not the company. If it wants to go higher over the near-term, I’m more than happy to hop on and enjoy the ride. If it wants to go lower, I can do that too. By the time the stock eventually settles into its “true” value, I’ll be long gone and it doesn’t matter to me.

Back to the stock, there are two ways to interpret this price action just under $800. What a person sees largely depends on their preexisting bias. Bears see a stock hitting its head on resistance and on the verge of tumbling back to $600 support. On the other side, bulls see a stock that refuses to go down. And the best part about a stock that refuses to go down? It eventually goes up.

Last week I would have sided with the bears. Smashing through resistance following a strong earnings report only to be overwhelmed by a tidal wave of profit-taking is never a good sign. And then the next day Elon slammed the stock even further by calling it overvalued. Yet rather than unleash waves of follow-on selling, supply dried up and prices bounce back to $800 and have been stuck there ever since.

For the time being, this is a strong sign and breaking through resistance in a sustainable way seems inevitable. That means the most likely next move is higher and if we get through $800, then all-time highs near $1,000 is the next stop. But that’s a big “IF”. If prices remain stuck under $800 into next week, this starts looking a lot more like stalling and the real problem turns out to be a lack of demand.

Which is it? Who cares? As nimble independent investors, we don’t need to commit ourselves to these positions ahead of time. Wait for the $800 breakout, buy it, and keep a stop under this level. If prices race higher, hang on and enjoy the ride. If the retreat again, bail out and go short. While I don’t know for certain which way this stock will go next, I do know it will move fast once it makes up its mind. Whether that is up or down, I don’t care as long as my trading plan keeps me on the right side.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI