Markets in decline as US prepares $200bn in tariffs against China

Equity markets in Europe are trading in the red once again on Wednesday and those in the US are on course to head in the same direction, as trade war fears once again take hold.

While this announcement has been expected ever since US President Donald Trump first hinted at such a response to Chinese retaliatory measures, it is a stark reminder that common sense is not prevailing – as many hoped – and the risk of a full blown trade war is very real. In instructing US trade representative Robert Lighthizer to start preparations for the new range of tariffs, Trump is showing that he is not bluffing and is willing to take this all the way which is very worrying.

Trump’s relationship with US’ allies will certainly come into focus in the coming days. The NATO meeting over the next 48 hours will certainly be a tasty affair with Trump having repeatedly and publicly bashed other members for their contributions, particularly Germany who the US President has also targeted on trade. He will then head to the UK which is facing something of a crisis itself and hoping it can rely on its “special relationship” to agree a good trade deal in the future and make a success of Brexit.

Carney one of many central bankers appearing today

While investors are very much focused on trade at the moment, there are a number of central bankers speaking today which will attract attention. With the UK potentially heading for a rate hike in August, the comments of Bank of England Governor Mark Carney will be particularly interesting, particularly given the political turmoil that the country is experiencing at the moment as it struggles to agree on its Brexit vision so close to exit day.

Of course, the Bank of Canada rate decision will be the headline act on the central bank scene today. It is widely expected to raise interest rates for the second time this year – the first hike coming in January – after the economy improved slightly in recent months and inflation rose also, although this has come as unemployment has ticked higher.

GBP holding up even as political landscape becomes more uncertain

Two high profile resignations have piled the pressure on Theresa May, who some believe may actually be stronger as a result. Should more follow though, a leadership challenge and even elections may result which would create a huge cloud of uncertainty for the country, negotiations and ultimately, investors. The pound has held up relatively well under the circumstances but I doubt that would last if May is replaced with a more outspoken Brexiteer or new elections are held.

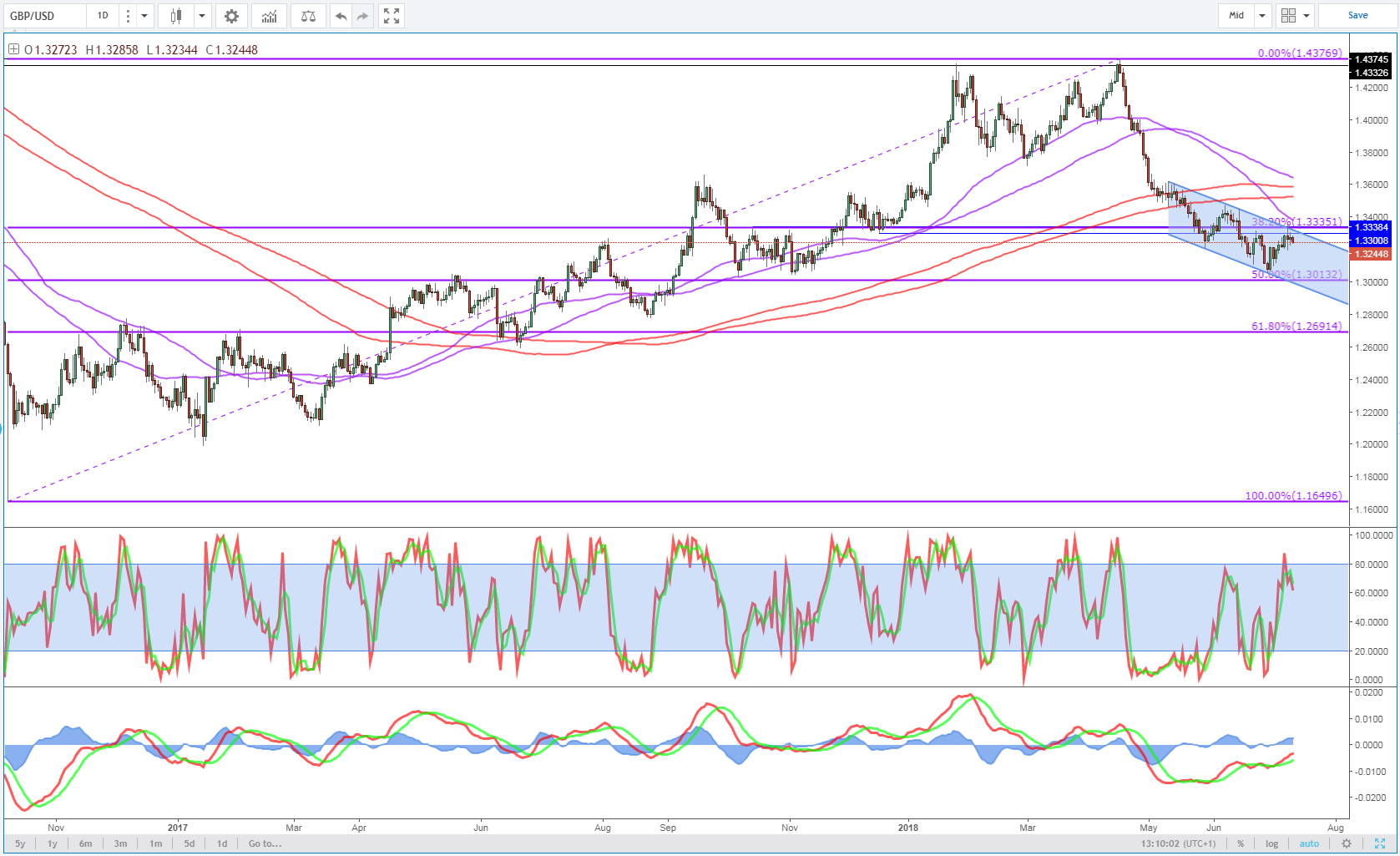

GBP/USD Daily Chart

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.