Apple edges up premarket as investors weigh estimated tariff costs, iPhone sales

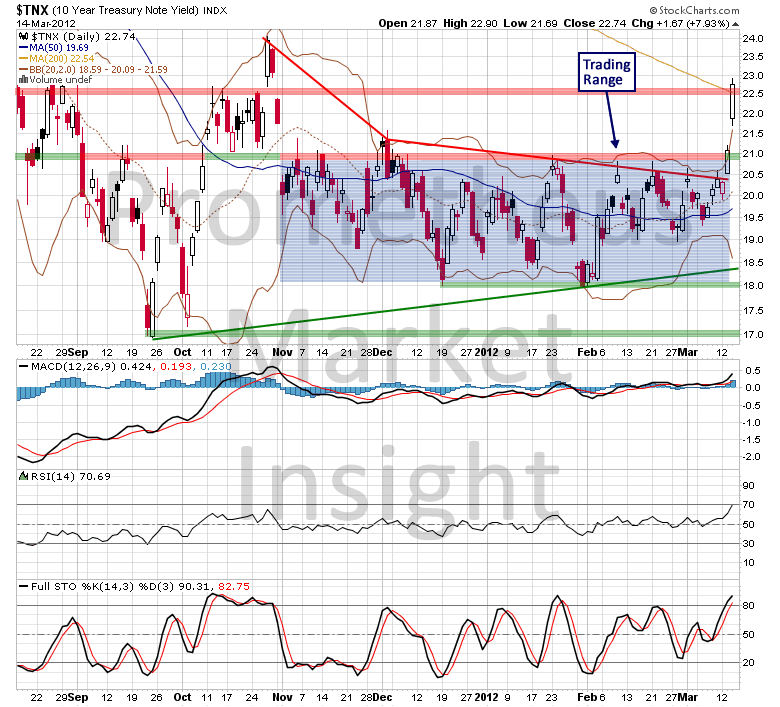

A subsequent close well above current levels would confirm a break above congestion resistance in the 2.25% area and forecast additional gains.

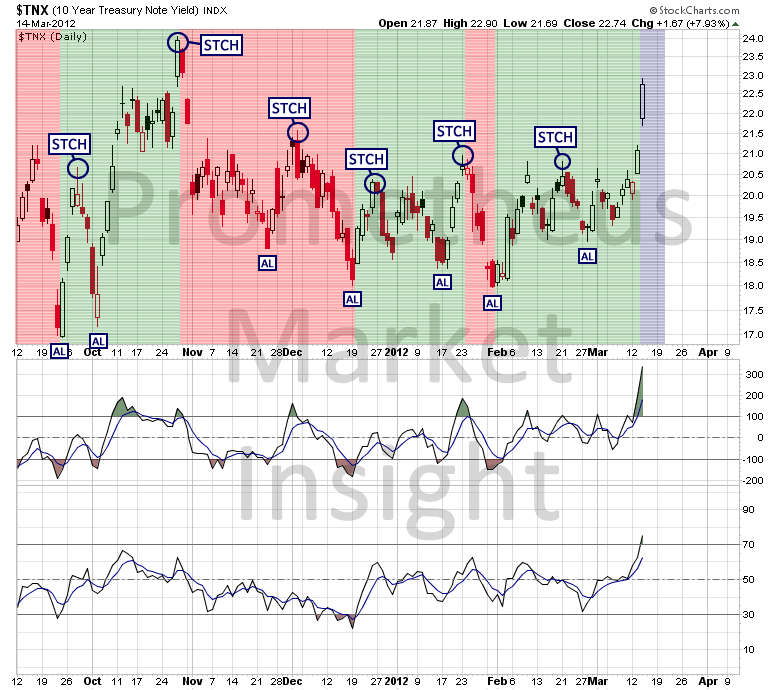

With respect to cycle analysis, the strong move higher reconfirms the bullish translation of the current cycle and favors additional short-term strength. However, we have entered the window during which the latest Short-Term Cycle High (STCH) is likely to form, so an overbought retracement could occur at any time during the next several sessions.

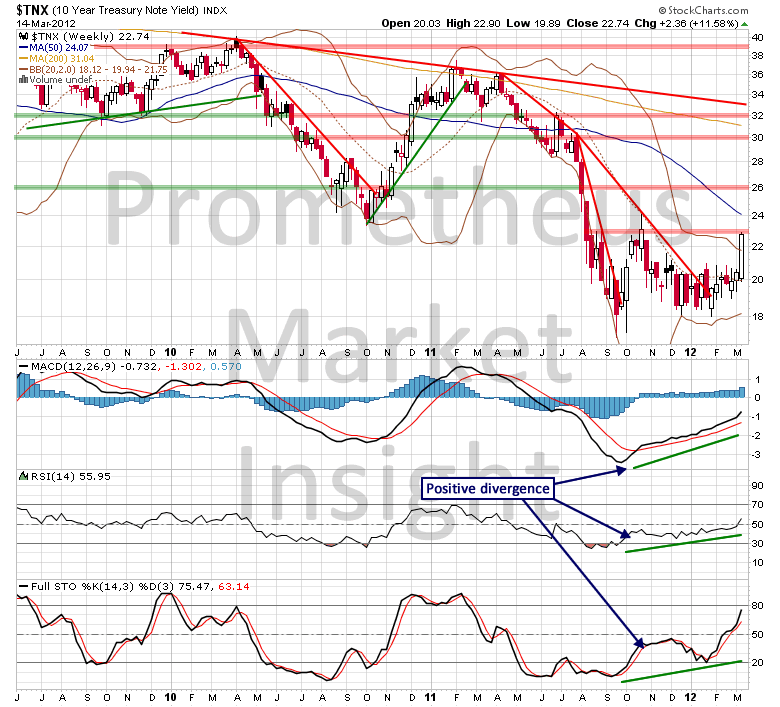

The positive divergence between technical indicators and yield behavior that we have been monitoring on the weekly chart favored the development of an oversold reaction and the rebound has already returned to relatively strong congestion resistance in the 2.30% area.

Now that the oversold condition created by the decline in 2011 has been cleared, yield behavior during the next several weeks will provide the next signal with respect to long-term direction.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.