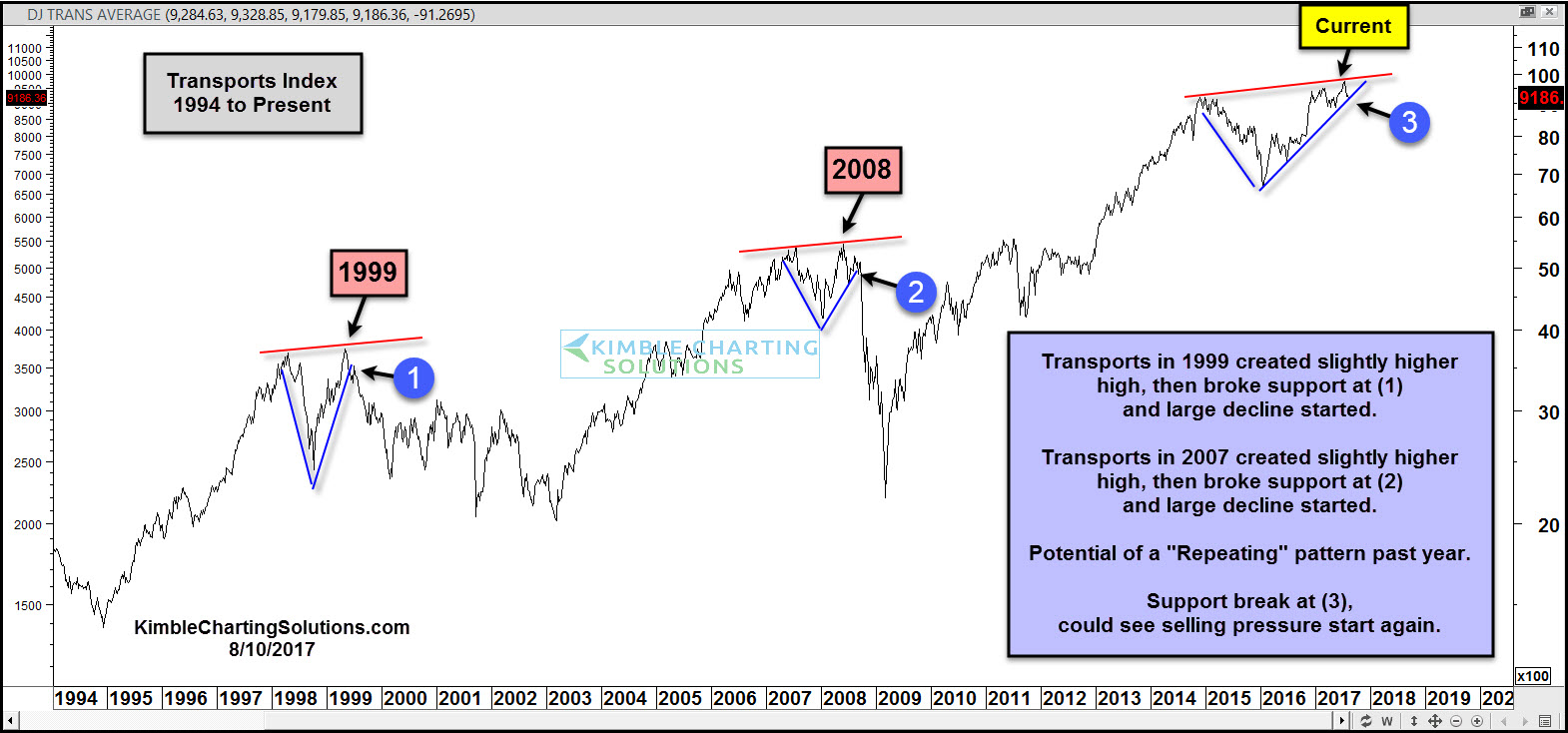

Below looks at the Dow Jones Transportation index since 1994. Is it possible that the index is repeating the same patterns we saw back in 1999 and 2007?

Below is an update on a potential pattern that we have been sharing with members for months.

In 1999, Transports closed slightly higher than in 1998, as it appeared that a bullish breakout was in play. Quickly the index reversed and broke support at (1), which was followed by a good deal of selling pressure, driving the index much lower. The breakout was nothing more than a fake out in 1999.

In 2008, Transports closed slightly higher than in 2007, which again looked like a bullish breakout was in play. The index soon reversed and broke support at (2), which was followed by selling pressure, driving the index lower. The breakout was nothing more than a fake out in 2008.

Over the past couple of years, the pattern in the transports looks a good deal like it did in 1999 and 2007. As we have been sharing with members for month, the odds of a repeat are low, yet if the pattern we are sharing is correct, the impact could be quite large.

At this time, the Transports index is testing rising support at (3). Even if the pattern does not repeat, if support gives way at (3), it could encourage selling in this important index.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI